Summary

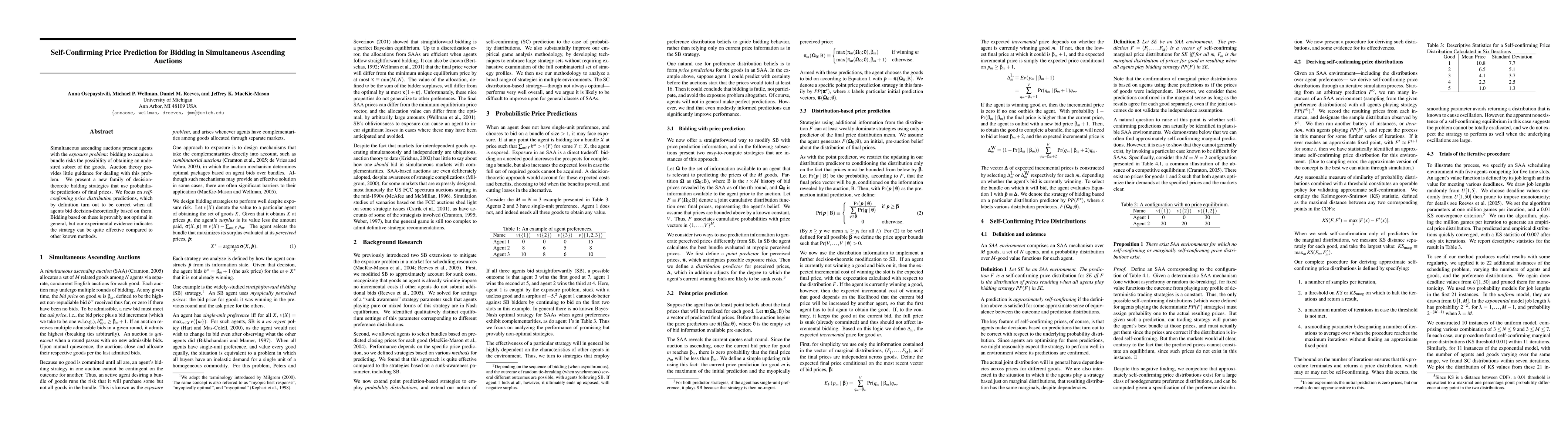

Simultaneous ascending auctions present agents with the exposure problem: bidding to acquire a bundle risks the possibility of obtaining an undesired subset of the goods. Auction theory provides little guidance for dealing with this problem. We present a new family of decisiontheoretic bidding strategies that use probabilistic predictions of final prices. We focus on selfconfirming price distribution predictions, which by definition turn out to be correct when all agents bid decision-theoretically based on them. Bidding based on these is provably not optimal in general, but our experimental evidence indicates the strategy can be quite effective compared to other known methods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBidding efficiently in Simultaneous Ascending Auctions with budget and eligibility constraints using Simultaneous Move Monte Carlo Tree Search

Alexandre Pacaud, Aurelien Bechler, Marceau Coupechoux

Bidding efficiently in Simultaneous Ascending Auctions with incomplete information using Monte Carlo Tree Search and determinization

Alexandre Pacaud, Marceau Coupechoux, Aurélien Bechler

Bidding in Uniform Price Auctions for Value Maximizing Buyers

Negin Golrezaei, Sourav Sahoo

| Title | Authors | Year | Actions |

|---|

Comments (0)