Summary

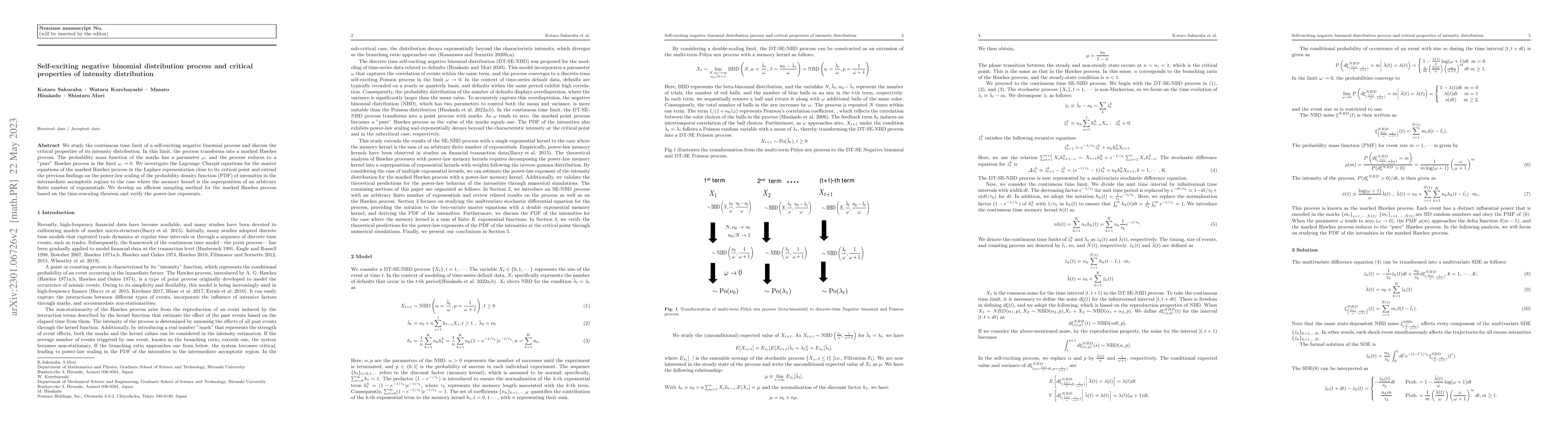

We study the continuous time limit of a self-exciting negative binomial process and discuss the critical properties of its intensity distribution. In this limit, the process transforms into a marked Hawkes process. The probability mass function of the marks has a parameter $\omega$, and the process reduces to a "pure" Hawkes process in the limit $\omega\to 0$. We investigate the Lagrange--Charpit equations for the master equations of the marked Hawkes process in the Laplace representation close to its critical point and extend the previous findings on the power-law scaling of the probability density function (PDF) of intensities in the intermediate asymptotic regime to the case where the memory kernel is the superposition of an arbitrary finite number of exponentials. We develop an efficient sampling method for the marked Hawkes process based on the time-rescaling theorem and verify the power-law exponents.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFrom the multi-terms urn model to the self-exciting negative binomial distribution and Hawkes processes

Shintaro Mori, Masato Hisakado, Kodai Hattori

Negative binomial-reciprocal inverse Gaussian distribution: Statistical properties with applications

Multi-Dimensional self-exciting NBD process and Default portfolios

Shintaro Mori, Masato Hisakado, Kodai Hattori

No citations found for this paper.

Comments (0)