Summary

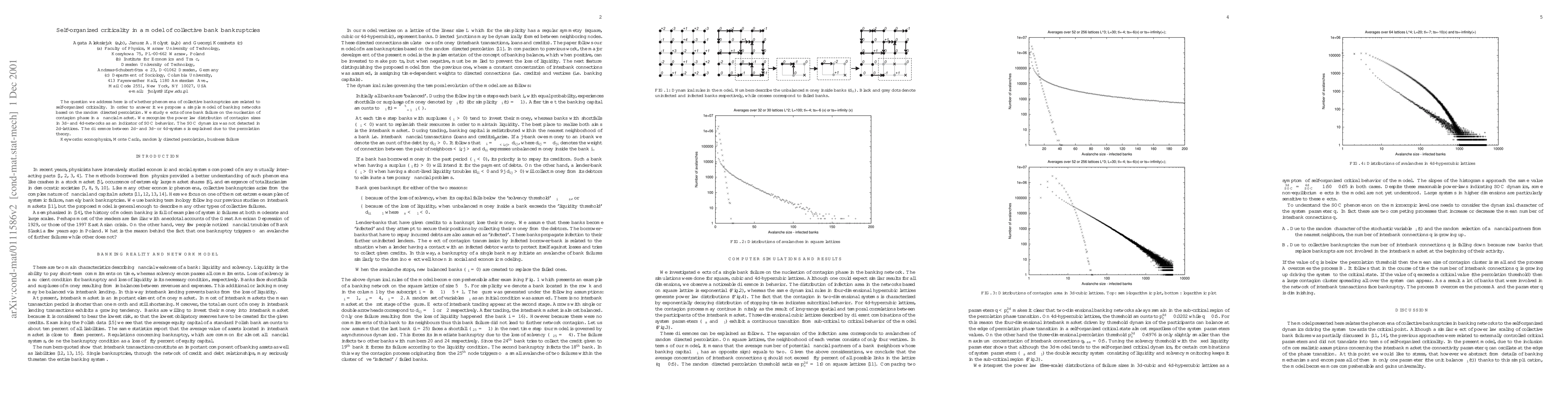

The question we address here is of whether phenomena of collective bankruptcies are related to self-organized criticality. In order to answer it we propose a simple model of banking networks based on the random directed percolation. We study effects of one bank failure on the nucleation of contagion phase in a financial market. We recognize the power law distribution of contagion sizes in 3d- and 4d-networks as an indicator of SOC behavior. The SOC dynamics was not detected in 2d-lattices. The difference between 2d- and 3d- or 4d-systems is explained due to the percolation theory.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)