Summary

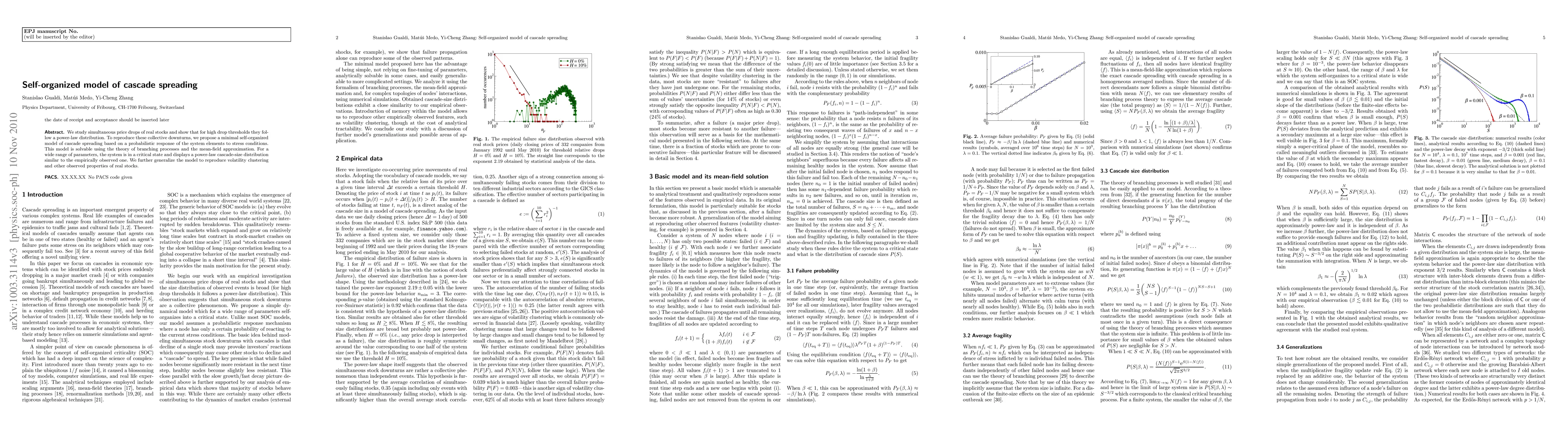

We study simultaneous price drops of real stocks and show that for high drop thresholds they follow a power-law distribution. To reproduce these collective downturns, we propose a minimal self-organized model of cascade spreading based on a probabilistic response of the system elements to stress conditions. This model is solvable using the theory of branching processes and the mean-field approximation. For a wide range of parameters, the system is in a critical state and displays a power-law cascade-size distribution similar to the empirically observed one. We further generalize the model to reproduce volatility clustering and other observed properties of real stocks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)