Authors

Summary

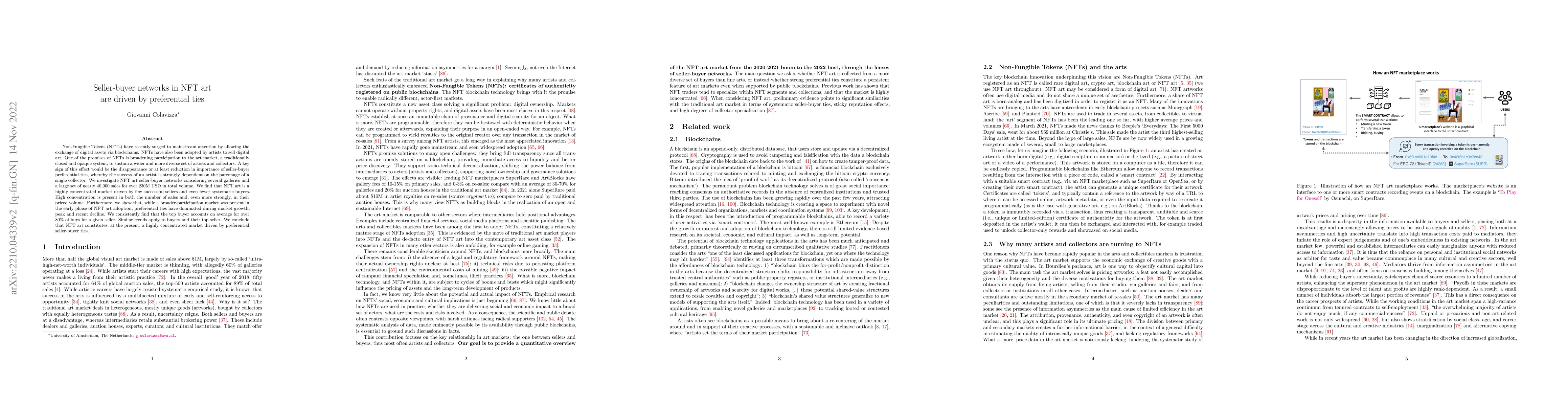

Non-Fungible Tokens (NFTs) have recently surged to mainstream attention by allowing the exchange of digital assets via blockchains. NFTs have also been adopted by artists to sell digital art. One of the promises of NFTs is broadening participation to the arts market, a traditionally closed and opaque system, to sustain a wider and more diverse set of artists and collectors. A key sign of this effect would be the disappearance or at least reduction in importance of seller-buyer preferential ties, whereby the success of an artist is strongly dependent on the patronage of a single collector. We investigate NFT art seller-buyer networks considering several galleries and a large set of nearly 40,000 sales for over 230M USD in total volume. We find that NFT art is a highly concentrated market driven by few successful sellers and even fewer systematic buyers. High concentration is present in both the number of sales and, even more strongly, in their priced volume. Furthermore, we show that, while a broader-participation market was present in the early phase of NFT art adoption, preferential ties have dominated during market growth, peak and recent decline. We consistently find that the top buyer accounts on average for over 80% of buys for a given seller. Similar trends apply to buyers and their top seller. We conclude that NFT art constitutes, at the present, a highly concentrated market driven by preferential seller-buyer ties.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersModel Copyright Protection in Buyer-seller Environment

Xinpeng Zhang, Nan Zhong, Zhenxing Qian et al.

Stochastic Geometry Analysis of Spectrum Sharing Among Multiple Seller and Buyer Mobile Operators

Mehdi Rasti, Pedro H. J. Nardelli, Elaheh Ataeebojd et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)