Summary

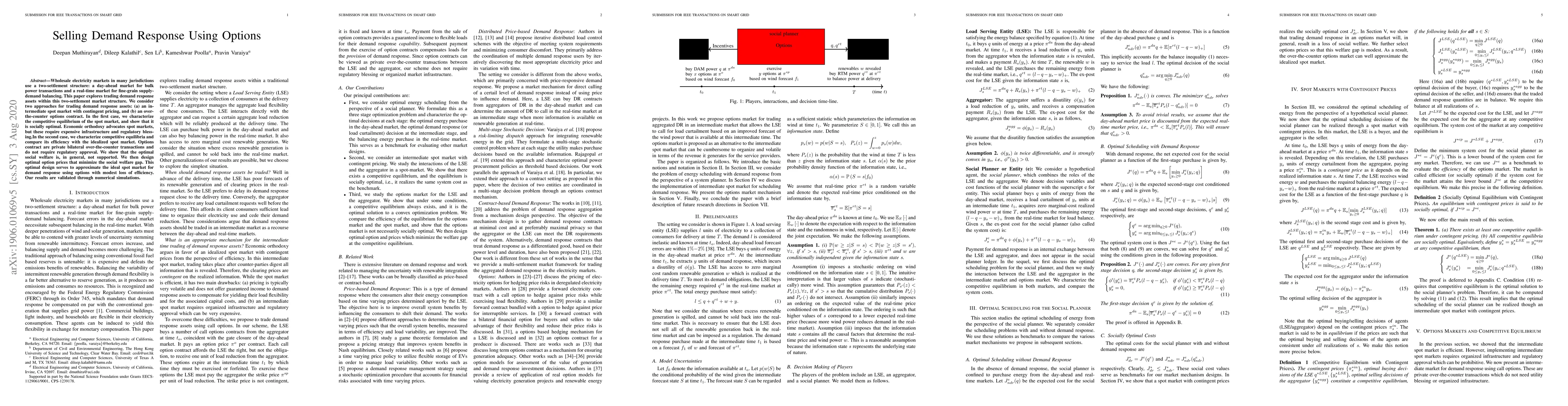

Wholesale electricity markets in many jurisdictions use a two-settlement structure: a day-ahead market for bulk power transactions and a real-time market for fine-grain supply-demand balancing. This paper explores trading demand response assets within this two-settlement market structure. We consider two approaches for trading demand response assets: (a) an intermediate spot market with contingent pricing, and (b) an over-the-counter options contract. In the first case, we characterize the competitive equilibrium of the spot market, and show that it is socially optimal. Economic orthodoxy advocates spot markets, but these require expensive infrastructure and regulatory blessing. In the second case, we characterize competitive equilibria and compare its efficiency with the idealized spot market. Options contract are private bilateral over-the-counter transactions and do not require regulatory approval. We show that the optimal social welfare is, in general, not supported. We then design optimal option prices that minimize the social welfare gap. This optimal design serves to approximate the ideal spot market for demand response using options with modest loss of efficiency. Our results are validated through numerical simulations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)