Summary

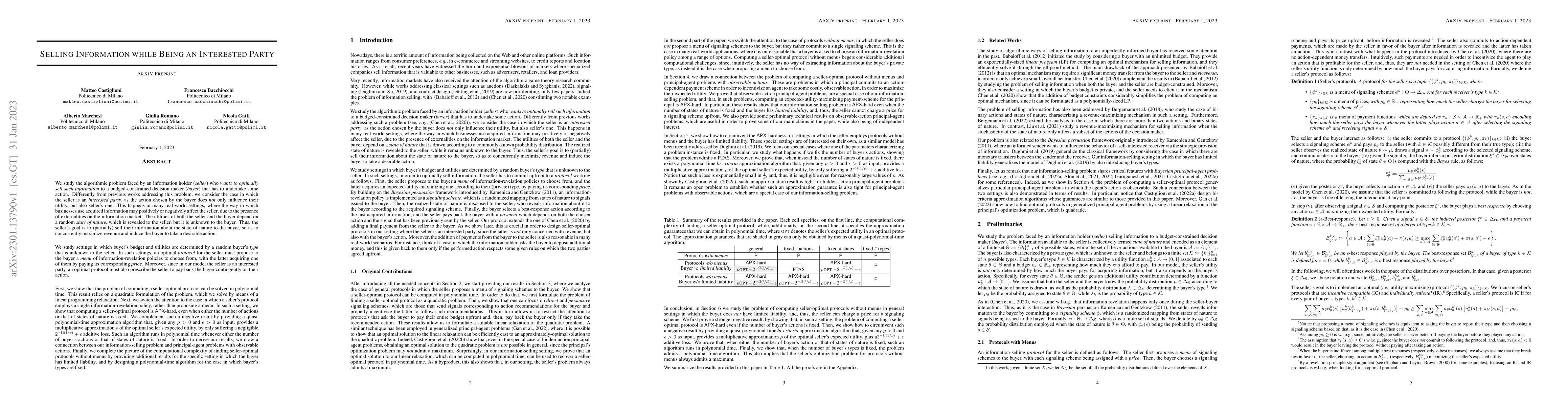

We study the algorithmic problem faced by an information holder (seller) who wants to optimally sell such information to a budged-constrained decision maker (buyer) that has to undertake some action. Differently from previous, we consider the case in which the seller is an interested party, as the action chosen by the buyer does not only influence their utility, but also seller's one. This happens in many real-world settings, where the way in which businesses use acquired information may positively or negatively affect the seller, due to the presence of externalities on the information market. The utilities of both the seller and the buyer depend on a random state of nature, which is revealed to the seller, but it is unknown to the buyer. Thus, the seller's goal is to (partially) sell their information about the state of nature to the buyer, so as to concurrently maximize revenue and induce the buyer to take a desirable action. We study settings in which buyer's budget and utilities are determined by a random buyer's type that is unknown to the seller. In such settings, an optimal protocol for the seller must propose to the buyer a menu of information-revelation policies to choose from, with the latter acquiring one of them by paying its corresponding price. Moreover, since in our model the seller is an interested party, an optimal protocol must also prescribe the seller to pay back the buyer contingently on their action. First, we show that the problem of computing a seller-optimal protocol can be solved in polynomial time. Next, we switch the attention to the case in which a seller's protocol employs a single information-revelation policy, rather than proposing a menu, deriving both positive and negative results.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersIs Selling Complete Information (Approximately) Optimal?

Yang Cai, Grigoris Velegkas, Dirk Bergemann et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)