Summary

In a financial market model, we consider the variance-optimal semi-static hedging of a given contingent claim, a generalization of the classic variance-optimal hedging. To obtain a tractable formula for the expected squared hedging error and the optimal hedging strategy, we use a Fourier approach in a general multidimensional semimartingale factor model. As a special case, we recover existing results for variance-optimal hedging in affine stochastic volatility models. We apply the theory to set up a variance-optimal semi-static hedging strategy for a variance swap in both the Heston and the 3/2-model, the latter of which is a non-affine stochastic volatility model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

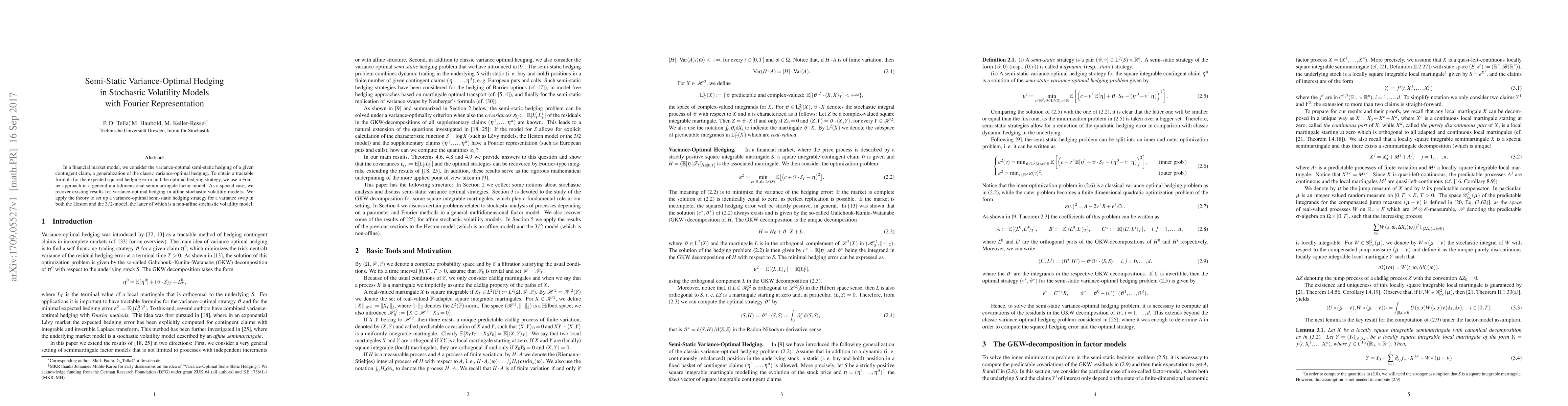

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)