Summary

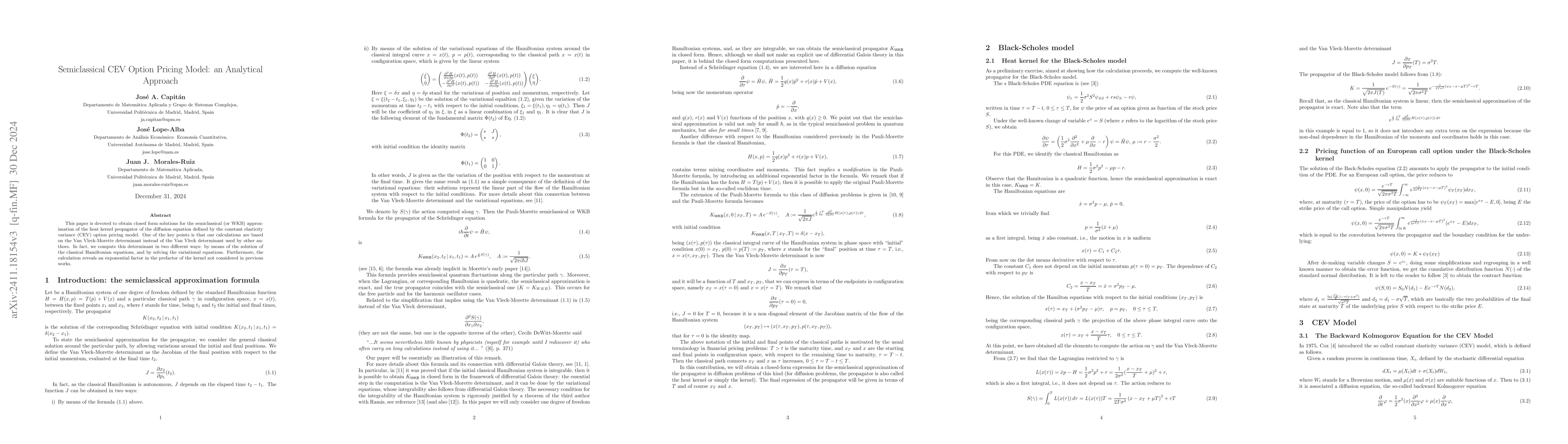

This paper is devoted to obtain closed form solutions for the semiclassical (or WKB) approximation of the heat kernel propagator of the diffusion equation defined by the constant elasticity variance (CEV) option pricing model. One of the key points is that our calculations are based on the Van Vleck-Morette determinant instead of the Van Vleck determinant used by other authors. In fact, we compute this determinant in two different ways: by means of the solution of the classical Hamiltonian equations, and by solving the variational equations. Furthermore, the calculation reveals an exponential factor in the prefactor of the kernel not considered in previous works.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)