Authors

Summary

Rough volatility models have recently been empirically shown to provide a good fit to historical volatility time series and implied volatility smiles of SPX options. They are continuous-time stochastic volatility models, whose volatility process is driven by a fractional Brownian motion with Hurst parameter less than half. Due to the challenge that it is neither a semimartingale nor a Markov process, there is no unified method that not only applies to all rough volatility models, but also is computationally efficient. This paper proposes a semimartingale and continuous-time Markov chain (CTMC) approximation approach for the general class of rough stochastic local volatility (RSLV) models. In particular, we introduce the perturbed stochastic local volatility (PSLV) model as the semimartingale approximation for the RSLV model and establish its existence , uniqueness and Markovian representation. We propose a fast CTMC algorithm and prove its weak convergence. Numerical experiments demonstrate the accuracy and high efficiency of the method in pricing European, barrier and American options. Comparing with existing literature, a significant reduction in the CPU time to arrive at the same level of accuracy is observed.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

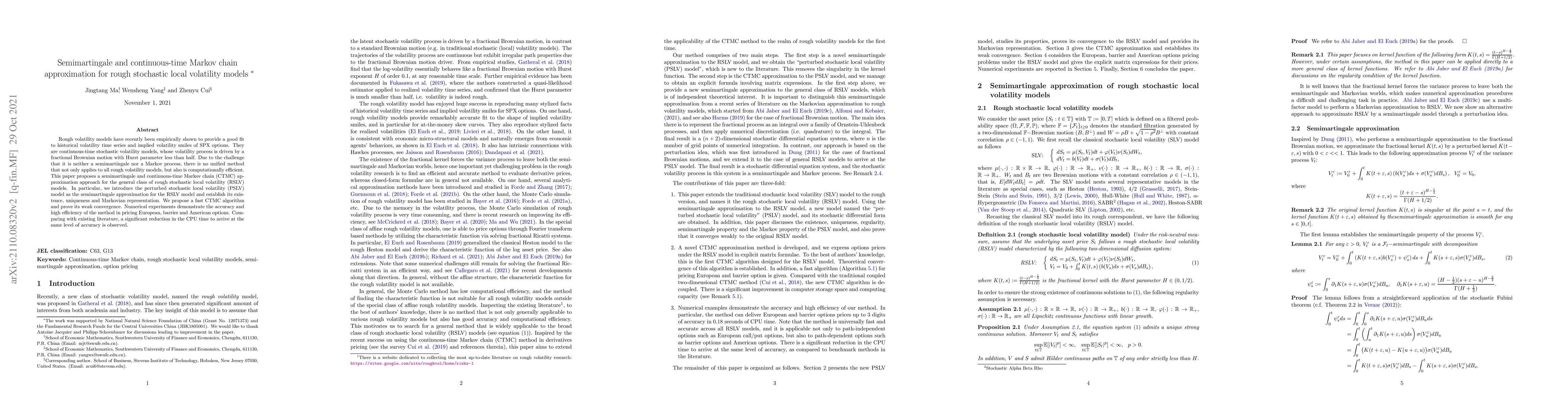

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRough PDEs for local stochastic volatility models

Peter K. Friz, Christian Bayer, Luca Pelizzari et al.

Local volatility under rough volatility

Peter K. Friz, Paolo Pigato, Stefano De Marco et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)