Summary

As the dynamic structure of the financial markets is subject to dramatic changes, a model capable of providing consistently accurate volatility estimates must not make strong assumptions on how prices change over time. Most volatility models impose a particular parametric functional form that relates an observed price change to a volatility forecast (news impact function). We propose a new class of functional coefficient semiparametric volatility models where the news impact function is allowed to be any smooth function, and study its ability to estimate volatilities compared to the well known parametric proposals, in both a simulation study and an empirical study with real financial data. We estimate the news impact function using a Bayesian model averaging approach, implemented via a carefully developed Markov chain Monte Carlo (MCMC) sampling algorithm. Using simulations we show that our flexible semiparametric model is able to learn the shape of the news impact function from the observed data. When applied to real financial time series, our new model suggests that the news impact functions are significantly different in shapes for different asset types, but are similar for the assets of the same type.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

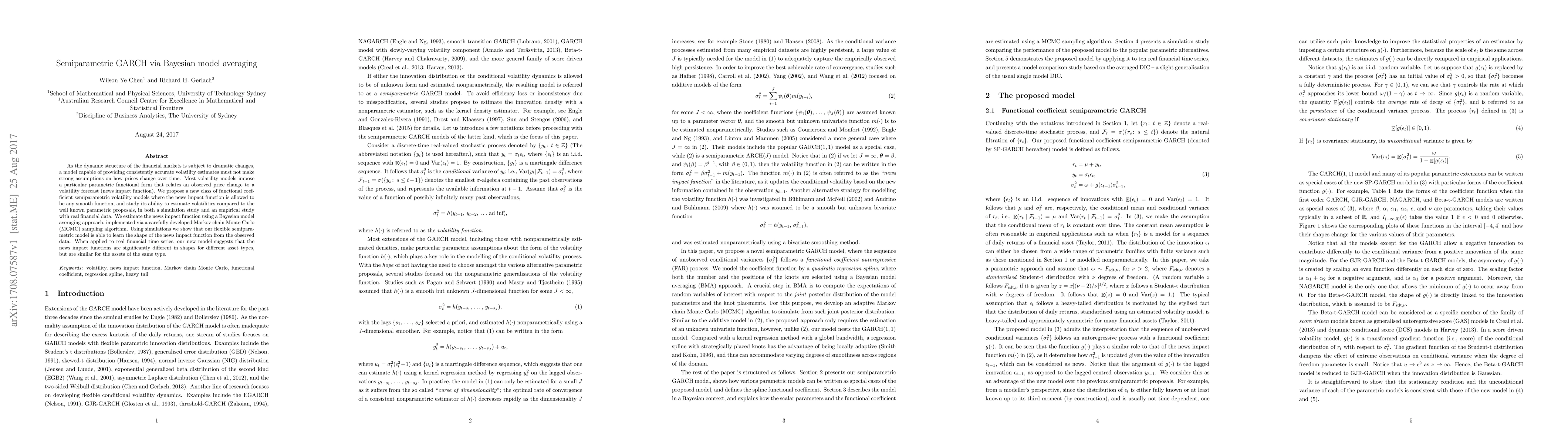

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHysteretic Multivariate Bayesian Structural GARCH Model with Soft Information

Ning Ning, Tzu-Hsin Chien, Shih-Feng Huang

| Title | Authors | Year | Actions |

|---|

Comments (0)