Authors

Summary

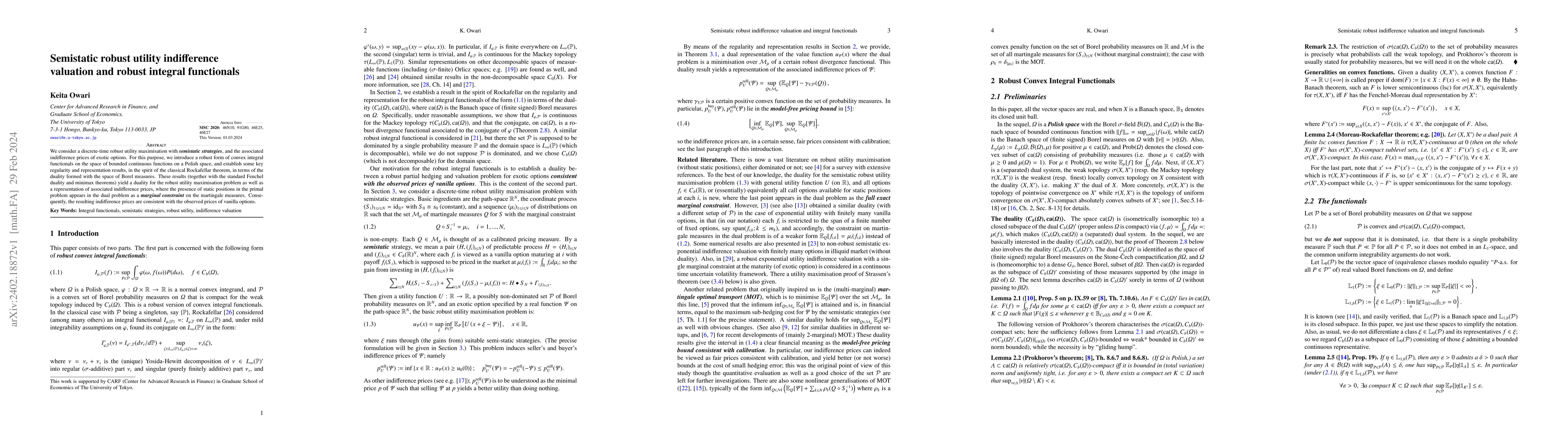

We consider a discrete-time robust utility maximisation with semistatic strategies, and the associated indifference prices of exotic options. For this purpose, we introduce a robust form of convex integral functionals on the space of bounded continuous functions on a Polish space, and establish some key regularity and representation results, in the spirit of the classical Rockafellar theorem, in terms of the duality formed with the space of Borel measures. These results (together with the standard Fenchel duality and minimax theorems) yield a duality for the robust utility maximisation problem as well as a representation of associated indifference prices, where the presence of static positions in the primal problem appears in the dual problem as a marginal constraint on the martingale measures. Consequently, the resulting indifference prices are consistent with the observed prices of vanilla options.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)