Authors

Summary

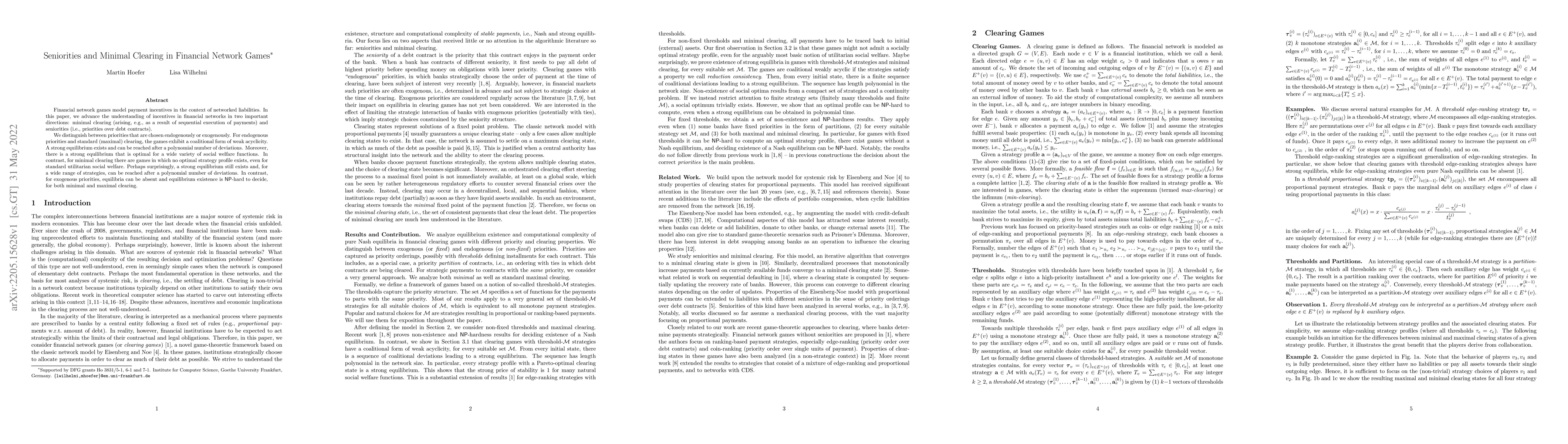

Financial network games model payment incentives in the context of networked liabilities. In this paper, we advance the understanding of incentives in financial networks in two important directions: minimal clearing (arising, e.g., as a result of sequential execution of payments) and seniorities (i.e., priorities over debt contracts). We distinguish between priorities that are chosen endogenously or exogenously. For endogenous priorities and standard (maximal) clearing, the games exhibit a coalitional form of weak acyclicity. A strong equilibrium exists and can be reached after a polynomial number of deviations. Moreover, there is a strong equilibrium that is optimal for a wide variety of social welfare functions. In contrast, for minimal clearing there are games in which no optimal strategy profile exists, even for standard utilitarian social welfare. Perhaps surprisingly, a strong equilibrium still exists and, for a wide range of strategies, can be reached after a polynomial number of deviations. In contrast, for exogenous priorities, equilibria can be absent and equilibrium existence is NP-hard to decide, for both minimal and maximal clearing.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersClearing Payments in Dynamic Financial Networks

Anton V. Proskurnikov, Giuseppe C. Calafiore, Giulia Fracastoro

Optimal Clearing Payments in a Financial Contagion Model

Anton V. Proskurnikov, Giuseppe Calafiore, Giulia Fracastoro

| Title | Authors | Year | Actions |

|---|

Comments (0)