Summary

We examine the issue of sensitivity with respect to model parameters for the problem of utility maximization from final wealth in an incomplete Samuelson model and mainly, but not exclusively, for utility functions of positive power-type. The method consists in moving the parameters through change of measure, which we call a weak perturbation, decoupling the usual wealth equation from the varying parameters. By rewriting the maximization problem in terms of a convex-analytical support function of a weakly-compact set, crucially leveraging on the work of Backhoff and Fontbona (SIFIN 2016), the previous formulation let us prove the Hadamard directional differentiability of the value function w.r.t. the drift and interest rate parameters, as well as for volatility matrices under a stability condition on their Kernel, and derive explicit expressions for the directional derivatives. We contrast our proposed weak perturbations against what we call strong perturbations, where the wealth equation is directly influenced by the changing parameters. Contrary to conventional wisdom, we find that both points of view generally yield different sensitivities unless e.g. if initial parameters and their perturbations are deterministic.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

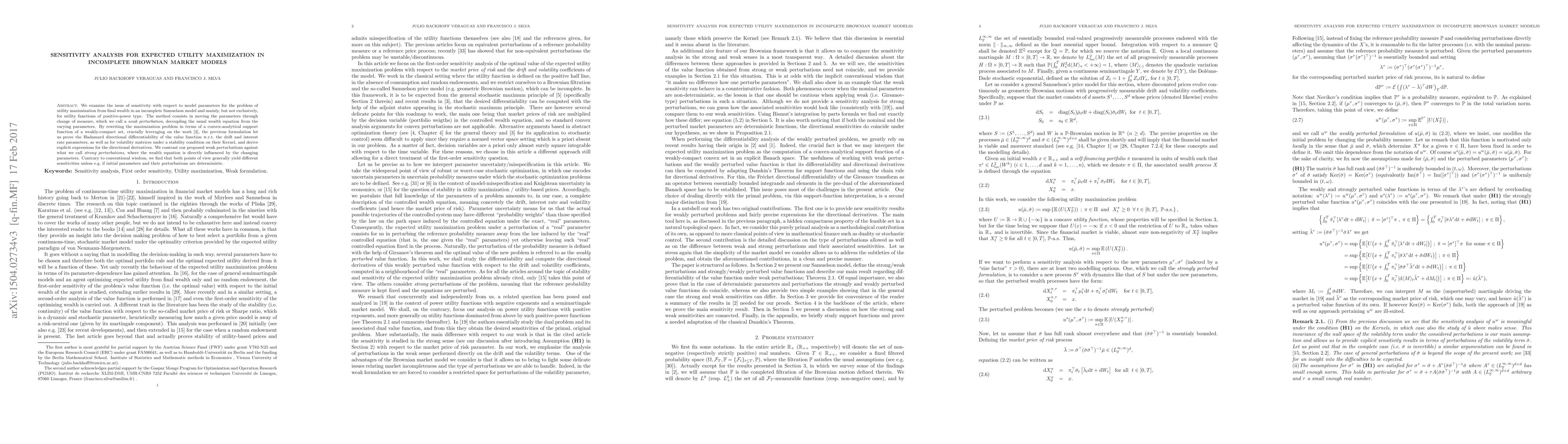

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)