Summary

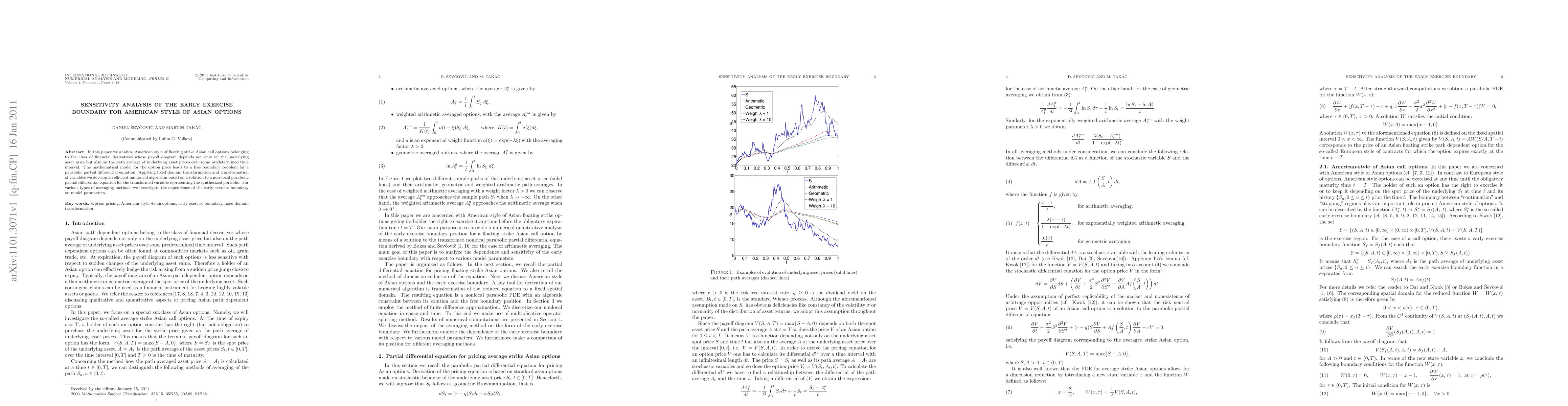

In this paper we analyze American style of floating strike Asian call options belonging to the class of financial derivatives whose payoff diagram depends not only on the underlying asset price but also on the path average of underlying asset prices over some predetermined time interval. The mathematical model for the option price leads to a free boundary problem for a parabolic partial differential equation. Applying fixed domain transformation and transformation of variables we develop an efficient numerical algorithm based on a solution to a non-local parabolic partial differential equation for the transformed variable representing the synthesized portfolio. For various types of averaging methods we investigate the dependence of the early exercise boundary on model parameters.

AI Key Findings - Failed

Key findings generation failed. Failed to start generation process

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)