Summary

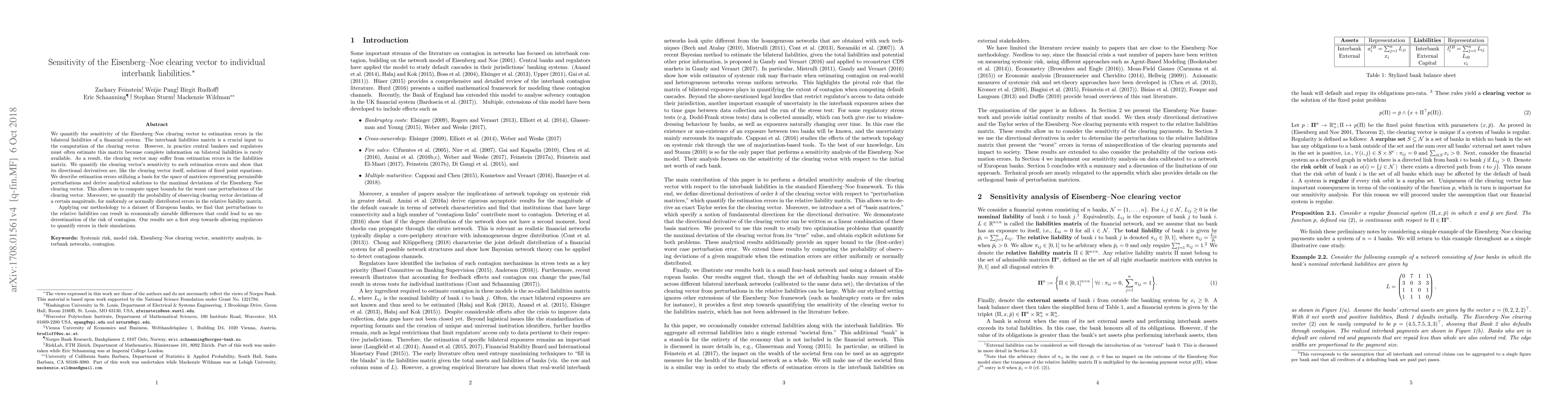

We quantify the sensitivity of the Eisenberg-Noe clearing vector to estimation errors in the bilateral liabilities of a financial system in a stylized setting. The interbank liabilities matrix is a crucial input to the computation of the clearing vector. However, in practice central bankers and regulators must often estimate this matrix because complete information on bilateral liabilities is rarely available. As a result, the clearing vector may suffer from estimation errors in the liabilities matrix. We quantify the clearing vector's sensitivity to such estimation errors and show that its directional derivatives are, like the clearing vector itself, solutions of fixed point equations. We describe estimation errors utilizing a basis for the space of matrices representing permissible perturbations and derive analytical solutions to the maximal deviations of the Eisenberg-Noe clearing vector. This allows us to compute upper bounds for the worst case perturbations of the clearing vector in our simple setting. Moreover, we quantify the probability of observing clearing vector deviations of a certain magnitude, for uniformly or normally distributed errors in the relative liability matrix. Applying our methodology to a dataset of European banks, we find that perturbations to the relative liabilities can result in economically sizeable differences that could lead to an underestimation of the risk of contagion. Our results are a first step towards allowing regulators to quantify errors in their simulations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDynamic Clearing and Contagion in Financial Networks

Zachary Feinstein, Tathagata Banerjee, Alex Bernstein

Clearing Payments in Dynamic Financial Networks

Anton V. Proskurnikov, Giuseppe C. Calafiore, Giulia Fracastoro

Clearing Sections of Lattice Liability Networks

Hans Riess, Miguel Lopez, Robert Ghrist et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)