Summary

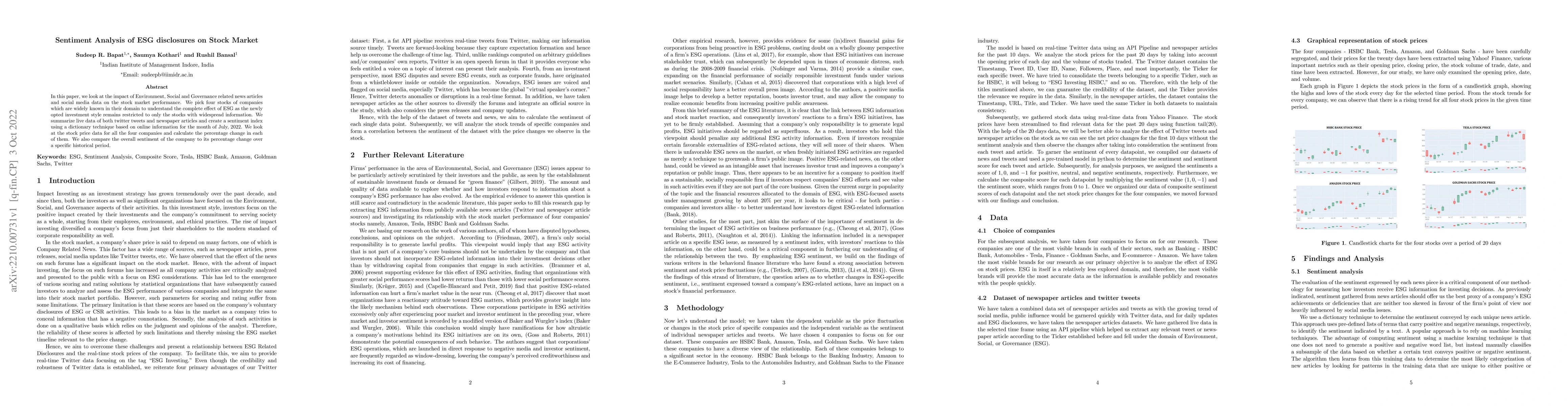

In this paper, we look at the impact of Environment, Social and Governance related news articles and social media data on the stock market performance. We pick four stocks of companies which are widely known in their domain to understand the complete effect of ESG as the newly opted investment style remains restricted to only the stocks with widespread information. We summarise live data of both twitter tweets and newspaper articles and create a sentiment index using a dictionary technique based on online information for the month of July, 2022. We look at the stock price data for all the four companies and calculate the percentage change in each of them. We also compare the overall sentiment of the company to its percentage change over a specific historical period.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGRUvader: Sentiment-Informed Stock Market Prediction

Bayode Ogunleye, Olamilekan Shobayo, Akhila Mamillapalli et al.

BERTopic-Driven Stock Market Predictions: Unraveling Sentiment Insights

Enmin Zhu, Jerome Yen

| Title | Authors | Year | Actions |

|---|

Comments (0)