Summary

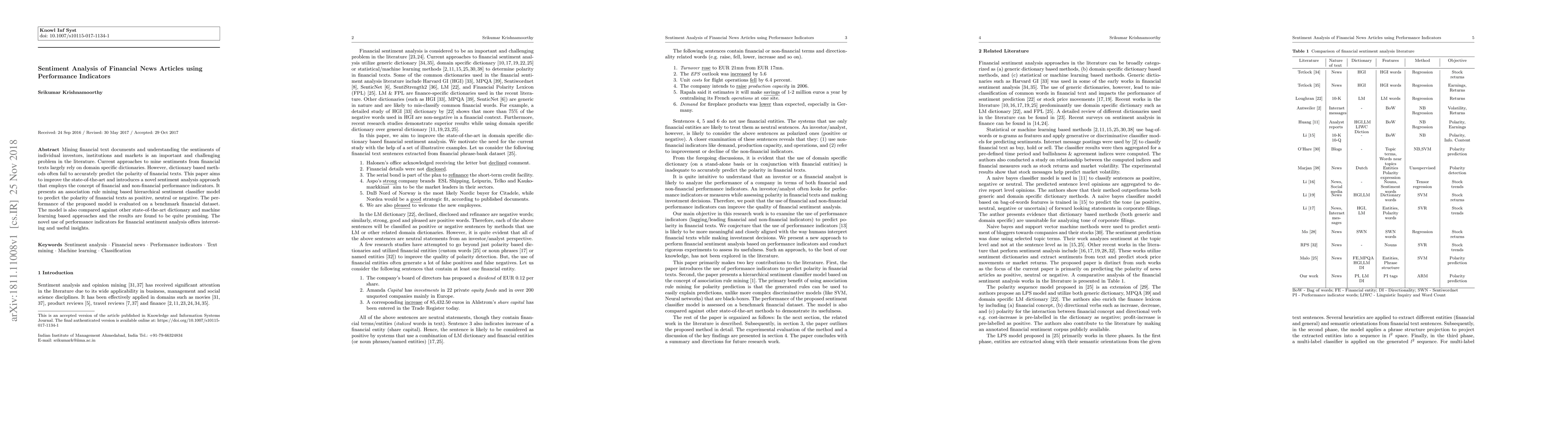

Mining financial text documents and understanding the sentiments of individual investors, institutions and markets is an important and challenging problem in the literature. Current approaches to mine sentiments from financial texts largely rely on domain specific dictionaries. However, dictionary based methods often fail to accurately predict the polarity of financial texts. This paper aims to improve the state-of-the-art and introduces a novel sentiment analysis approach that employs the concept of financial and non-financial performance indicators. It presents an association rule mining based hierarchical sentiment classifier model to predict the polarity of financial texts as positive, neutral or negative. The performance of the proposed model is evaluated on a benchmark financial dataset. The model is also compared against other state-of-the-art dictionary and machine learning based approaches and the results are found to be quite promising. The novel use of performance indicators for financial sentiment analysis offers interesting and useful insights.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFinancial Sentiment Analysis on News and Reports Using Large Language Models and FinBERT

Yanxin Shen, Pulin Kirin Zhang

SEntFiN 1.0: Entity-Aware Sentiment Analysis for Financial News

Ankur Sinha, Rishu Kumar, Pekka Malo et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)