Summary

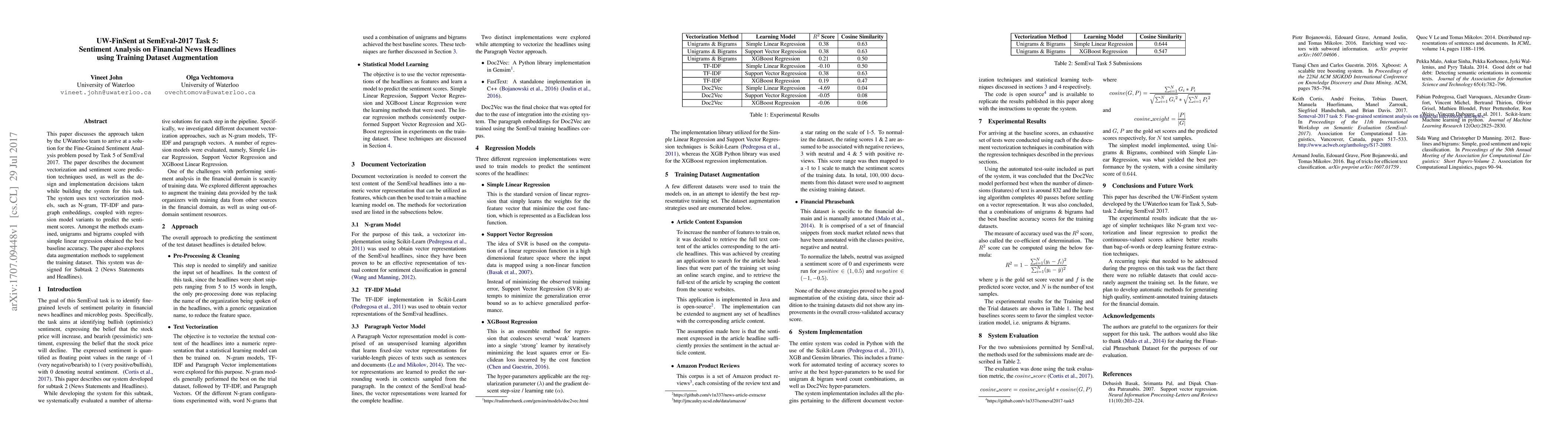

This paper discusses the approach taken by the UWaterloo team to arrive at a solution for the Fine-Grained Sentiment Analysis problem posed by Task 5 of SemEval 2017. The paper describes the document vectorization and sentiment score prediction techniques used, as well as the design and implementation decisions taken while building the system for this task. The system uses text vectorization models, such as N-gram, TF-IDF and paragraph embeddings, coupled with regression model variants to predict the sentiment scores. Amongst the methods examined, unigrams and bigrams coupled with simple linear regression obtained the best baseline accuracy. The paper also explores data augmentation methods to supplement the training dataset. This system was designed for Subtask 2 (News Statements and Headlines).

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFine-Tuning Gemma-7B for Enhanced Sentiment Analysis of Financial News Headlines

Chang Yu, Kangtong Mo, Wenyan Liu et al.

NIFTY Financial News Headlines Dataset

Frank Rudzicz, Raeid Saqur, Ken Kato et al.

SEntFiN 1.0: Entity-Aware Sentiment Analysis for Financial News

Ankur Sinha, Rishu Kumar, Pekka Malo et al.

A Spanish dataset for Targeted Sentiment Analysis of political headlines

Juan Manuel Pérez, Damián Furman, Tomás Alves Salgueiro et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)