Summary

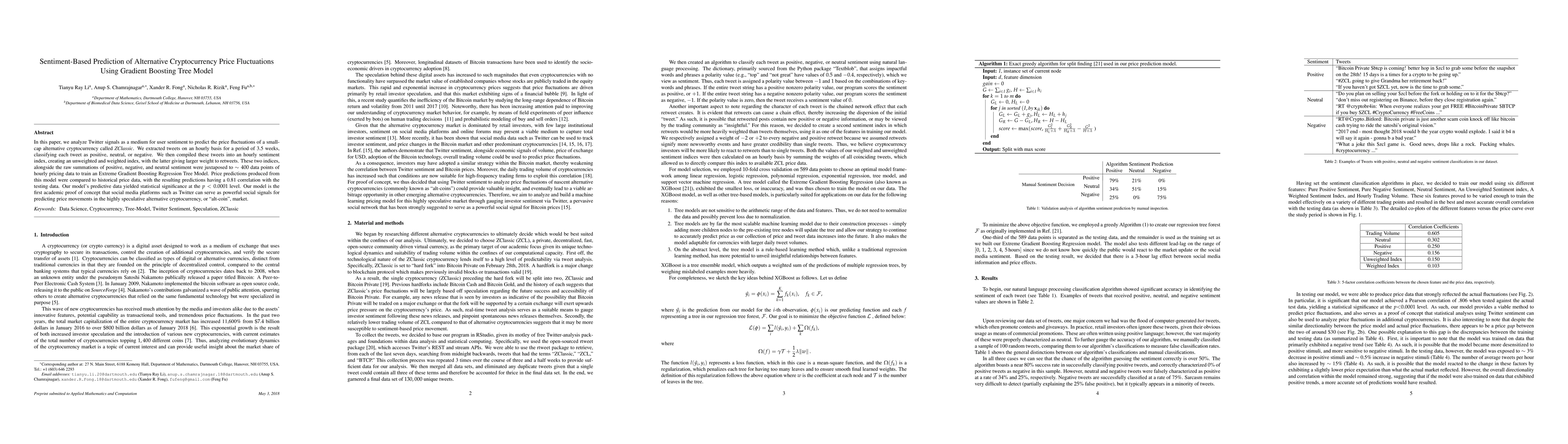

In this paper, we analyze Twitter signals as a medium for user sentiment to predict the price fluctuations of a small-cap alternative cryptocurrency called \emph{ZClassic}. We extracted tweets on an hourly basis for a period of 3.5 weeks, classifying each tweet as positive, neutral, or negative. We then compiled these tweets into an hourly sentiment index, creating an unweighted and weighted index, with the latter giving larger weight to retweets. These two indices, alongside the raw summations of positive, negative, and neutral sentiment were juxtaposed to $\sim 400$ data points of hourly pricing data to train an Extreme Gradient Boosting Regression Tree Model. Price predictions produced from this model were compared to historical price data, with the resulting predictions having a 0.81 correlation with the testing data. Our model's predictive data yielded statistical significance at the $p < 0.0001$ level. Our model is the first academic proof of concept that social media platforms such as Twitter can serve as powerful social signals for predicting price movements in the highly speculative alternative cryptocurrency, or "alt-coin", market.

AI Key Findings

Generated Sep 03, 2025

Methodology

The research utilized Twitter signals for sentiment analysis to predict price fluctuations of ZClassic, a small-cap alternative cryptocurrency. Tweets were classified as positive, neutral, or negative using natural language processing, with sentiment scores assigned based on a dictionary primarily sourced from the Textblob Python package. Two sentiment indices were created: an unweighted and a weighted one, with the latter giving more weight to retweets. These indices, along with raw sentiment sums, were used to train an Extreme Gradient Boosting Regression Tree Model.

Key Results

- The model achieved a 0.81 correlation with testing data, demonstrating statistical significance at the $p < 0.0001$ level.

- The study provides the first academic proof of concept that social media platforms like Twitter can serve as powerful social signals for predicting price movements in the alt-coin market.

- The natural language processing algorithm showed significant accuracy in identifying tweet sentiments, with a near 80% success rate in classifying positive tweets correctly.

Significance

This research is significant as it demonstrates the potential of using social media sentiment analysis for predicting price fluctuations in the highly speculative alternative cryptocurrency market. It opens up new avenues for investors and traders to incorporate social media signals into their trading strategies.

Technical Contribution

The paper introduces a novel approach for predicting cryptocurrency price fluctuations by leveraging Twitter sentiment analysis using an Extreme Gradient Boosting Regression Tree Model.

Novelty

This research stands out as the first academic proof of concept demonstrating the utility of social media sentiment, specifically from Twitter, in predicting price movements within the alternative cryptocurrency market.

Limitations

- The study was limited to a 3.5-week dataset due to the constraints of the cryptocurrency's fork and computational capacity.

- The model's accuracy could be improved by incorporating data from other social media platforms and refining the sentiment analysis algorithm to better detect sarcasm.

Future Work

- Further research could explore the application of this methodology to other alternative cryptocurrencies like ZCash and Bitcoin Private.

- Expanding the dataset and training the model over a longer period would likely improve prediction accuracy.

- Incorporating additional data sources, such as Google Search results, Facebook posts, and Reddit posts, could enhance the model's predictive capabilities.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCryptocurrency Price Prediction using Twitter Sentiment Analysis

Haritha GB, Sahana N. B

Vehicle Price Prediction By Aggregating decision tree model With Boosting Model

Auwal Tijjani Amshi

| Title | Authors | Year | Actions |

|---|

Comments (0)