Summary

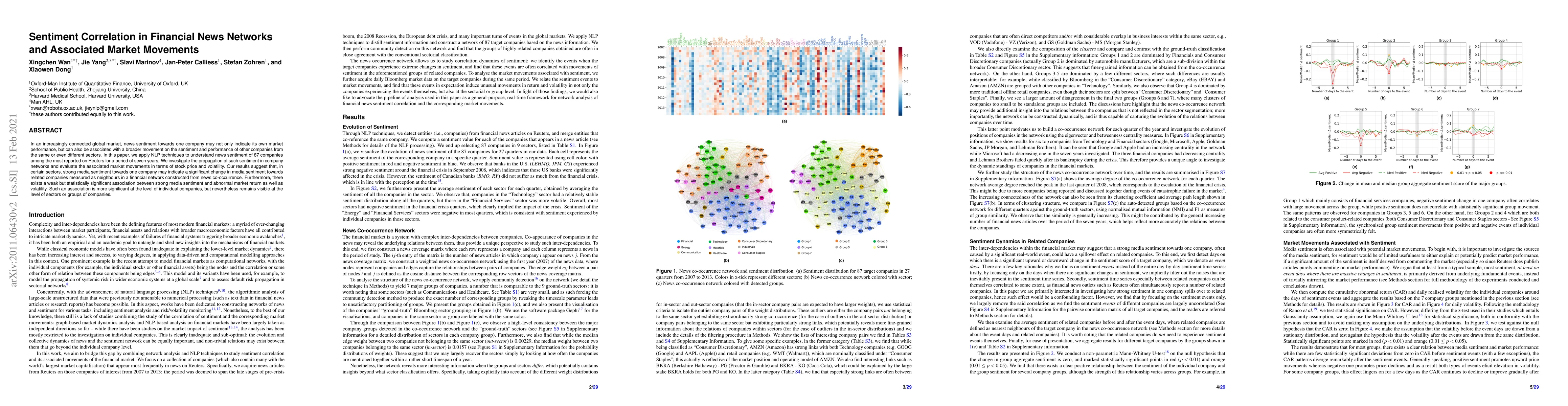

In an increasingly connected global market, news sentiment towards one company may not only indicate its own market performance, but can also be associated with a broader movement on the sentiment and performance of other companies from the same or even different sectors. In this paper, we apply NLP techniques to understand news sentiment of 87 companies among the most reported on Reuters for a period of seven years. We investigate the propagation of such sentiment in company networks and evaluate the associated market movements in terms of stock price and volatility. Our results suggest that, in certain sectors, strong media sentiment towards one company may indicate a significant change in media sentiment towards related companies measured as neighbours in a financial network constructed from news co-occurrence. Furthermore, there exists a weak but statistically significant association between strong media sentiment and abnormal market return as well as volatility. Such an association is more significant at the level of individual companies, but nevertheless remains visible at the level of sectors or groups of companies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersModeling News Interactions and Influence for Financial Market Prediction

Mengyu Wang, Shay B. Cohen, Tiejun Ma

Cross-Lingual News Event Correlation for Stock Market Trend Prediction

Seemab Latif, Rabia Latif, Sahar Arshad et al.

SEntFiN 1.0: Entity-Aware Sentiment Analysis for Financial News

Ankur Sinha, Rishu Kumar, Pekka Malo et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)