Summary

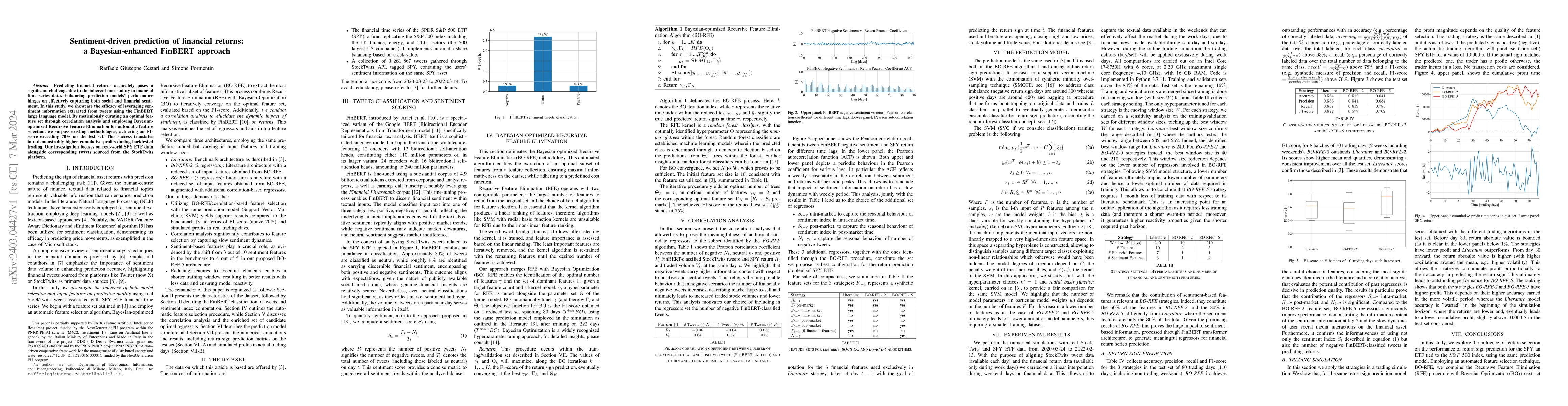

Predicting financial returns accurately poses a significant challenge due to the inherent uncertainty in financial time series data. Enhancing prediction models' performance hinges on effectively capturing both social and financial sentiment. In this study, we showcase the efficacy of leveraging sentiment information extracted from tweets using the FinBERT large language model. By meticulously curating an optimal feature set through correlation analysis and employing Bayesian-optimized Recursive Feature Elimination for automatic feature selection, we surpass existing methodologies, achieving an F1-score exceeding 70% on the test set. This success translates into demonstrably higher cumulative profits during backtested trading. Our investigation focuses on real-world SPY ETF data alongside corresponding tweets sourced from the StockTwits platform.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInnovative Sentiment Analysis and Prediction of Stock Price Using FinBERT, GPT-4 and Logistic Regression: A Data-Driven Approach

Bayode Ogunleye, Olamilekan Shobayo, Sidikat Adeyemi-Longe et al.

Financial Sentiment Analysis on News and Reports Using Large Language Models and FinBERT

Yanxin Shen, Pulin Kirin Zhang

No citations found for this paper.

Comments (0)