Summary

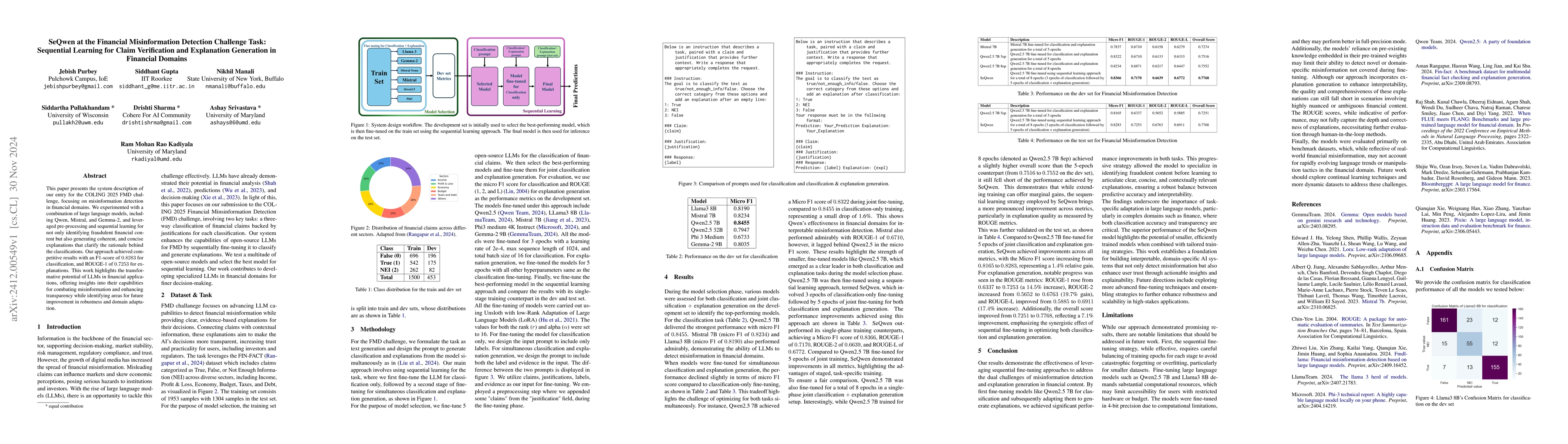

This paper presents the system description of our entry for the COLING 2025 FMD challenge, focusing on misinformation detection in financial domains. We experimented with a combination of large language models, including Qwen, Mistral, and Gemma-2, and leveraged pre-processing and sequential learning for not only identifying fraudulent financial content but also generating coherent, and concise explanations that clarify the rationale behind the classifications. Our approach achieved competitive results with an F1-score of 0.8283 for classification, and ROUGE-1 of 0.7253 for explanations. This work highlights the transformative potential of LLMs in financial applications, offering insights into their capabilities for combating misinformation and enhancing transparency while identifying areas for future improvement in robustness and domain adaptation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFMDLlama: Financial Misinformation Detection based on Large Language Models

Jimin Huang, Sophia Ananiadou, Qianqian Xie et al.

FinDVer: Explainable Claim Verification over Long and Hybrid-Content Financial Documents

Chen Zhao, Xiangru Tang, Arman Cohan et al.

L3iTC at the FinLLM Challenge Task: Quantization for Financial Text Classification & Summarization

Elvys Linhares Pontes, Mohamed Benjannet, Carlos-Emiliano González-Gallardo et al.

'Finance Wizard' at the FinLLM Challenge Task: Financial Text Summarization

Meisin Lee, Soon Lay-Ki

No citations found for this paper.

Comments (0)