Authors

Summary

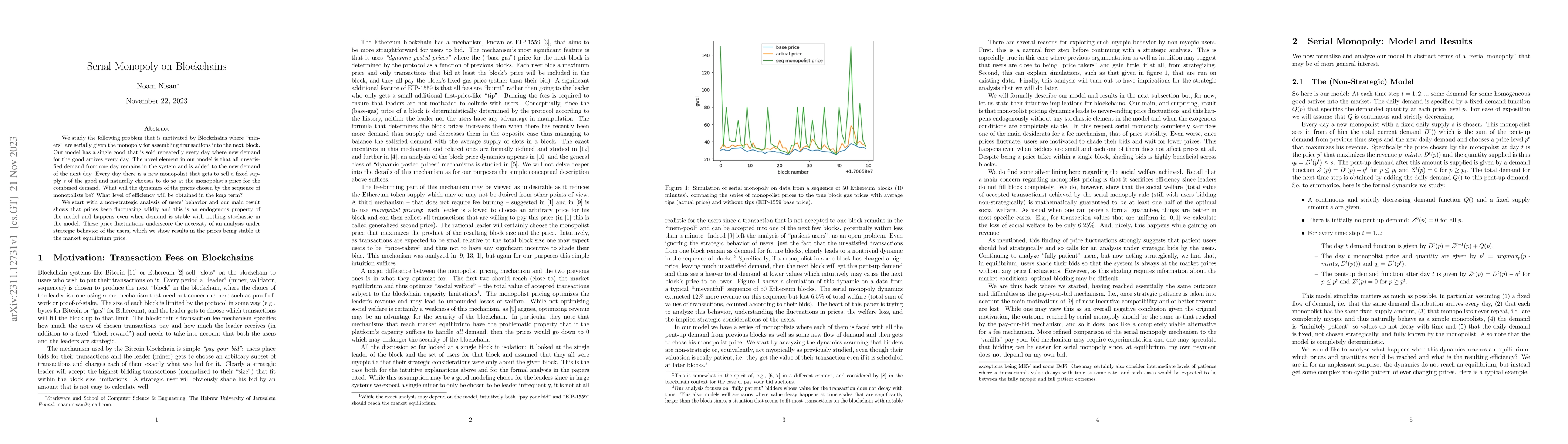

We study the following problem that is motivated by Blockchains where ``miners'' are serially given the monopoly for assembling transactions into the next block. Our model has a single good that is sold repeatedly every day where new demand for the good arrives every day. The novel element in our model is that all unsatisfied demand from one day remains in the system and is added to the new demand of the next day. Every day there is a new monopolist that gets to sell a fixed supply $s$ of the good and naturally chooses to do so at the monopolist's price for the combined demand. What will the dynamics of the prices chosen by the sequence of monopolists be? What level of efficiency will be obtained in the long term? We start with a non-strategic analysis of users' behavior and our main result shows that prices keep fluctuating wildly and this is an endogenous property of the model and happens even when demand is stable with nothing stochastic in the model. These price fluctuations underscore the necessity of an analysis under strategic behavior of the users, which we show results in the prices being stable at the market equilibrium price.

AI Key Findings

Generated Sep 03, 2025

Methodology

The research employs a model of serial monopoly on blockchains, analyzing price dynamics with a single good sold daily, where unsatisfied demand accumulates over days. It combines non-strategic and strategic user behavior analyses.

Key Results

- Price fluctuations are endogenous even with stable demand, emphasizing the need for strategic user behavior analysis.

- Under strategic behavior, prices stabilize at the market equilibrium price.

- A price psers exists such that all demand above it is supplied within a bounded time, and demand below it is never supplied.

- The social welfare achieved by serial monopolists approximates the optimal social welfare, with a bound of at least half.

- In strategic equilibrium, the system reverts to the market equilibrium of true demand, optimizing social welfare and giving up revenue optimization.

Significance

This research is significant for understanding the dynamics of monopolistic pricing in blockchain systems, providing insights into price stability and social welfare approximation, which are crucial for designing efficient decentralized marketplaces.

Technical Contribution

The paper presents a novel model for analyzing serial monopoly dynamics on blockchains, identifying key price behavior patterns and establishing bounds on social welfare approximation.

Novelty

The research introduces a unique approach to modeling serial monopoly behavior on blockchains, distinguishing itself by examining both non-strategic and strategic user behaviors and establishing important theoretical bounds on price stability and social welfare.

Limitations

- The analysis assumes a simplified deterministic model without stochastic elements, which may not fully capture real-world blockchain variability.

- The study focuses on a non-stochastic deterministic model, potentially limiting the applicability to more complex, stochastic blockchain environments.

Future Work

- Investigate the impact of stochastic demand and supply on price dynamics and social welfare.

- Explore the effects of different manipulation functions on equilibrium outcomes.

- Analyze the implications of introducing transaction costs and varying block sizes on the model.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSerial Monopoly on Blockchains with Quasi-patient Users

Paolo Penna, Manvir Schneider

A Circuit Approach to Constructing Blockchains on Blockchains

Yifei Wang, David Tse, Ertem Nusret Tas

| Title | Authors | Year | Actions |

|---|

Comments (0)