Summary

Risk measures for multivariate financial positions are studied in a utility-based framework. Under a certain incomplete preference relation, shortfall and divergence risk measures are defined as the optimal values of specific set minimization problems. The dual relationship between these two classes of multivariate risk measures is constructed via a recent Lagrange duality for set optimization. In particular, it is shown that a shortfall risk measure can be written as an intersection over a family of divergence risk measures indexed by a scalarization parameter. Examples include set-valued versions of the entropic risk measure and the average value at risk. As a second step, the minimization of these risk measures subject to trading opportunities is studied in a general convex market in discrete time. The optimal value of the minimization problem, called the market risk measure, is also a set-valued risk measure. A dual representation for the market risk measure that decomposes the effects of the original risk measure and the frictions of the market is proved.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

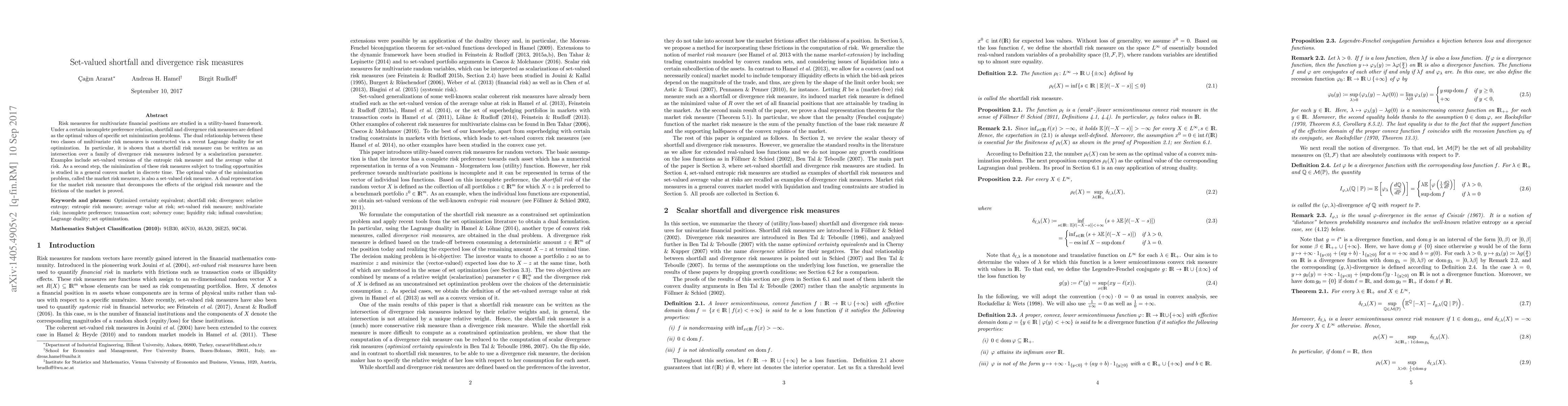

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSet-valued intrinsic measures of systemic risk

Birgit Rudloff, Jana Hlavinova, Alexander Smirnow

| Title | Authors | Year | Actions |

|---|

Comments (0)