Authors

Summary

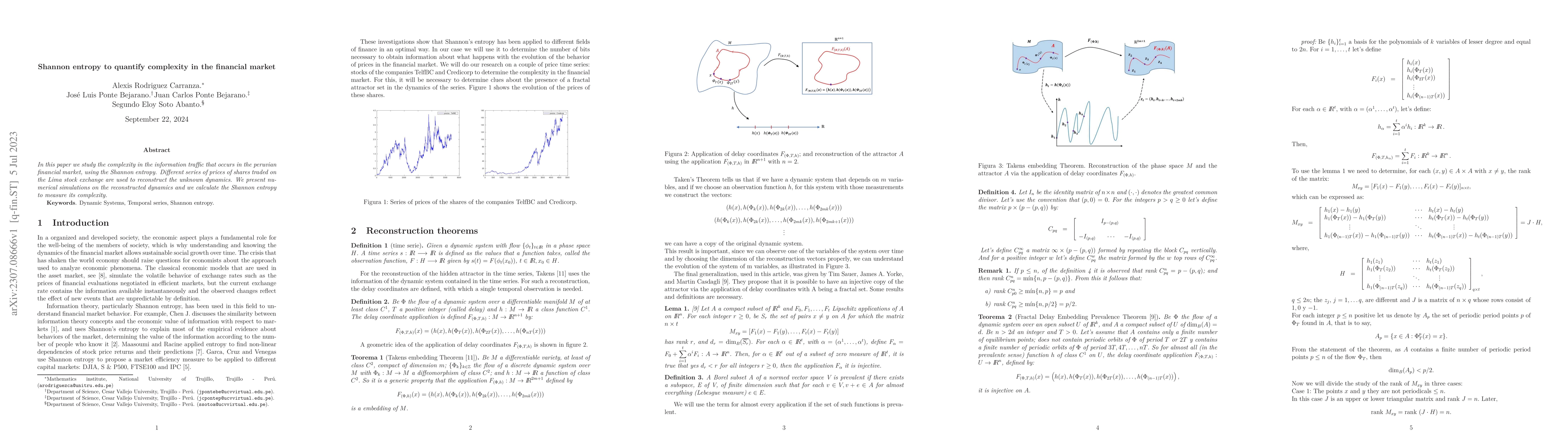

In this paper we study the complexity in the information traffic that occurs in the peruvian financial market, using the Shannon entropy. Different series of prices of shares traded on the Lima stock exchange are used to reconstruct the unknown dynamics. We present numerical simulations on the reconstructed dynamics and we calculate the Shannon entropy to measure its complexity

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)