Summary

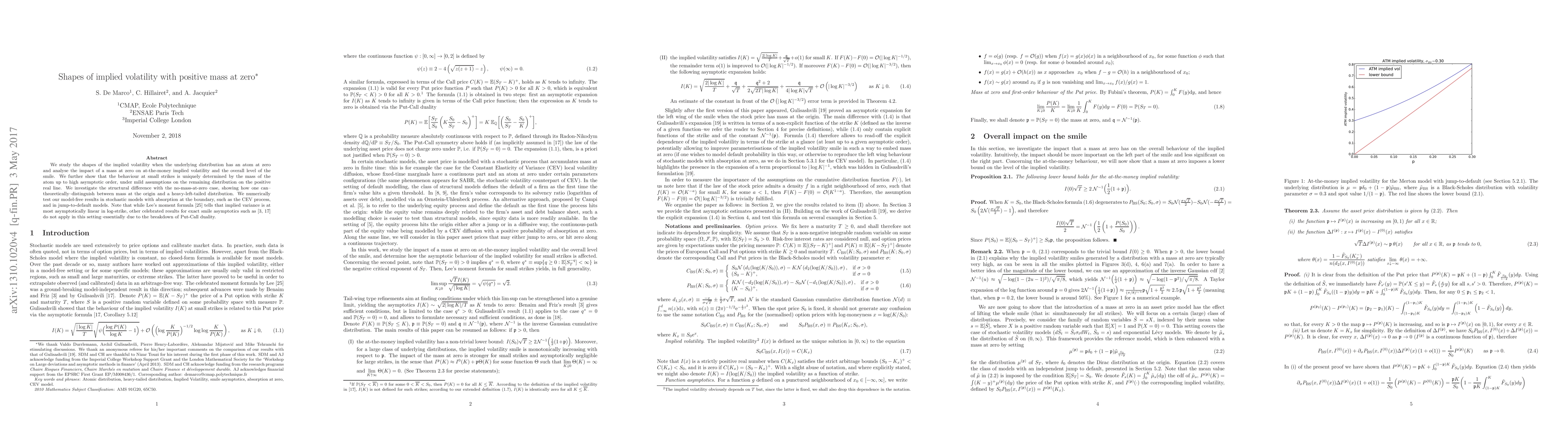

We study the shapes of the implied volatility when the underlying distribution has an atom at zero and analyse the impact of a mass at zero on at-the-money implied volatility and the overall level of the smile. We further show that the behaviour at small strikes is uniquely determined by the mass of the atom up to high asymptotic order, under mild assumptions on the remaining distribution on the positive real line. We investigate the structural difference with the no-mass-at-zero case, showing how one can--theoretically--distinguish between mass at the origin and a heavy-left-tailed distribution. We numerically test our model-free results in stochastic models with absorption at the boundary, such as the CEV process, and in jump-to-default models. Note that while Lee's moment formula tells that implied variance is at most asymptotically linear in log-strike, other celebrated results for exact smile asymptotics such as Benaim and Friz (09) or Gulisashvili (10) do not apply in this setting--essentially due to the breakdown of Put-Call duality.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)