Summary

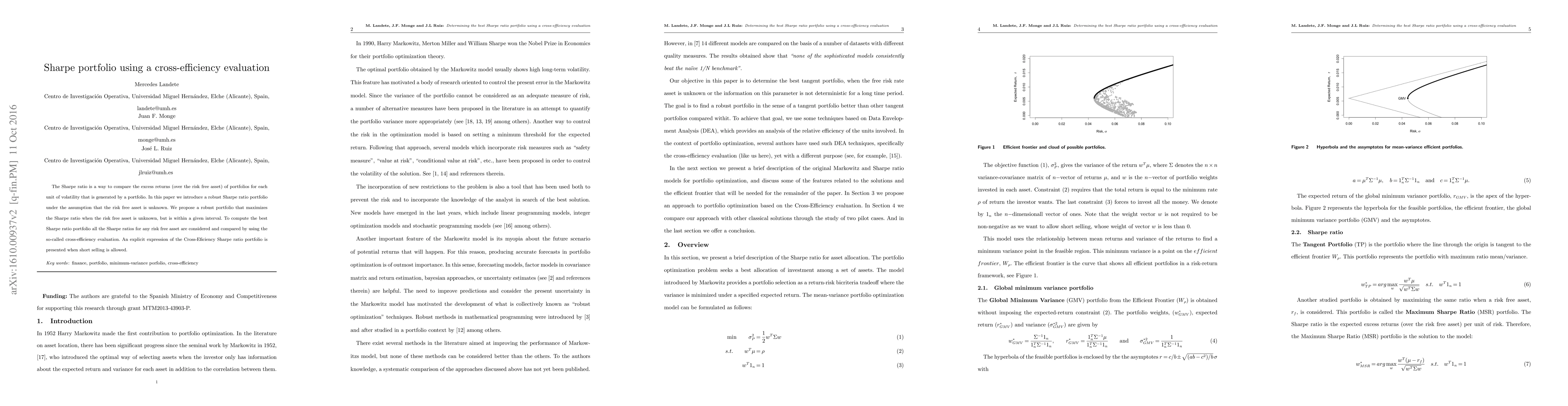

The Sharpe ratio is a way to compare the excess returns (over the risk free asset) of portfolios for each unit of volatility that is generated by a portfolio. In this paper we introduce a robust Sharpe ratio portfolio under the assumption that the risk free asset is unknown. We propose a robust portfolio that maximizes the Sharpe ratio when the risk free asset is unknown, but is within a given interval. To compute the best Sharpe ratio portfolio all the Sharpe ratios for any risk free asset are considered and compared by using the so-called cross-efficiency evaluation. An explicit expression of the Cross-Eficiency Sharpe ratio portfolio is presented when short selling is allowed.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Globally Optimal Portfolio for m-Sparse Sharpe Ratio Maximization

Cheng Li, Zhao-Rong Lai, Yizun Lin

Estimation of Out-of-Sample Sharpe Ratio for High Dimensional Portfolio Optimization

Yuan Cao, Xuran Meng, Weichen Wang

Optimizing Portfolio Performance through Clustering and Sharpe Ratio-Based Optimization: A Comparative Backtesting Approach

Keon Vin Park

Double Descent in Portfolio Optimization: Dance between Theoretical Sharpe Ratio and Estimation Accuracy

Yanrong Yang, Yonghe Lu, Terry Zhang

| Title | Authors | Year | Actions |

|---|

Comments (0)