Authors

Summary

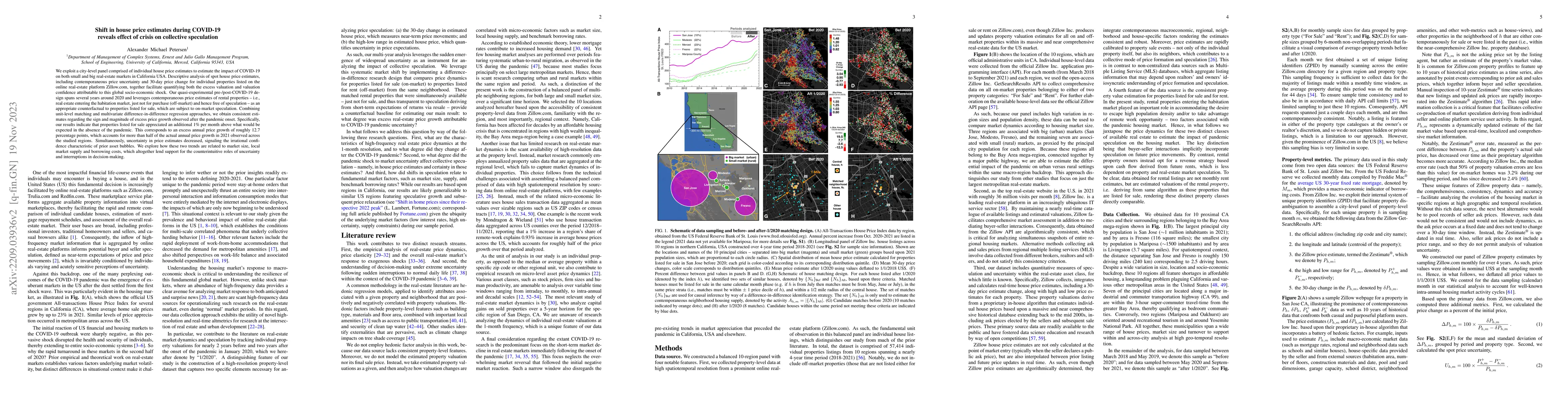

We exploit a city-level panel comprised of individual house price estimates to estimate the impact of COVID-19 on both small and big real-estate markets in California USA. Descriptive analysis of spot house price estimates, including contemporaneous price uncertainty and 30-day price change for individual properties listed on the online real-estate platform Zillow.com, together facilitate quantifying both the excess valuation and valuation confidence attributable to this global socio-economic shock. Our quasi-experimental pre-/post-COVID-19 design spans several years around 2020 and leverages contemporaneous price estimates of rental properties - i.e., real estate entering the habitation market, just not for purchase (off-market) and hence free of speculation - as an appropriate counterfactual to properties listed for sale, which are subject to on-market speculation. Combining unit-level matching and multivariate difference-in-difference regression approaches, we obtain consistent estimates regarding the sign and magnitude of excess price growth observed after the pandemic onset. Specifically, our results indicate that properties listed for sale appreciated an additional 1% per month above what would be expected in the absence of the pandemic. This corresponds to an excess annual price growth of roughly 12.7 percentage points, which accounts for more than half of the actual annual price growth in 2021 observed across the studied regions. Simultaneously, uncertainty in price estimates decreased, signaling the irrational confidence characteristic of prior asset bubbles. We explore how these two trends are related to market size, local market supply and borrowing costs, which altogether lend support for the counterintuitive roles of uncertainty and interruptions in decision-making.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)