Summary

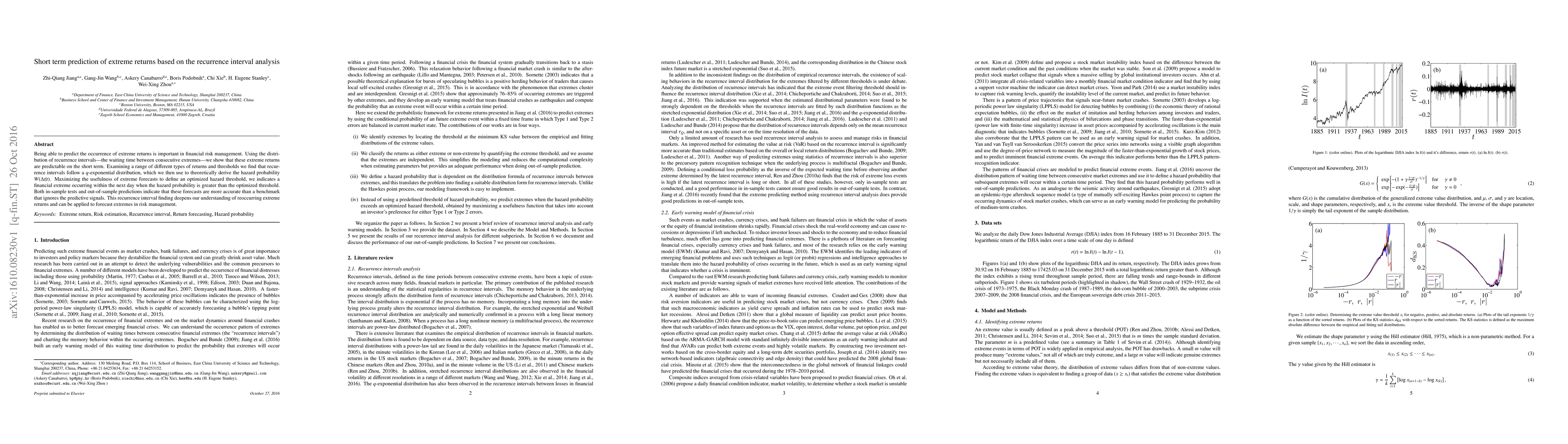

Being able to predict the occurrence of extreme returns is important in financial risk management. Using the distribution of recurrence intervals---the waiting time between consecutive extremes---we show that these extreme returns are predictable on the short term. Examining a range of different types of returns and thresholds we find that recurrence intervals follow a $q$-exponential distribution, which we then use to theoretically derive the hazard probability $W(\Delta t |t)$. Maximizing the usefulness of extreme forecasts to define an optimized hazard threshold, we indicates a financial extreme occurring within the next day when the hazard probability is greater than the optimized threshold. Both in-sample tests and out-of-sample predictions indicate that these forecasts are more accurate than a benchmark that ignores the predictive signals. This recurrence interval finding deepens our understanding of reoccurring extreme returns and can be applied to forecast extremes in risk management.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)