Authors

Summary

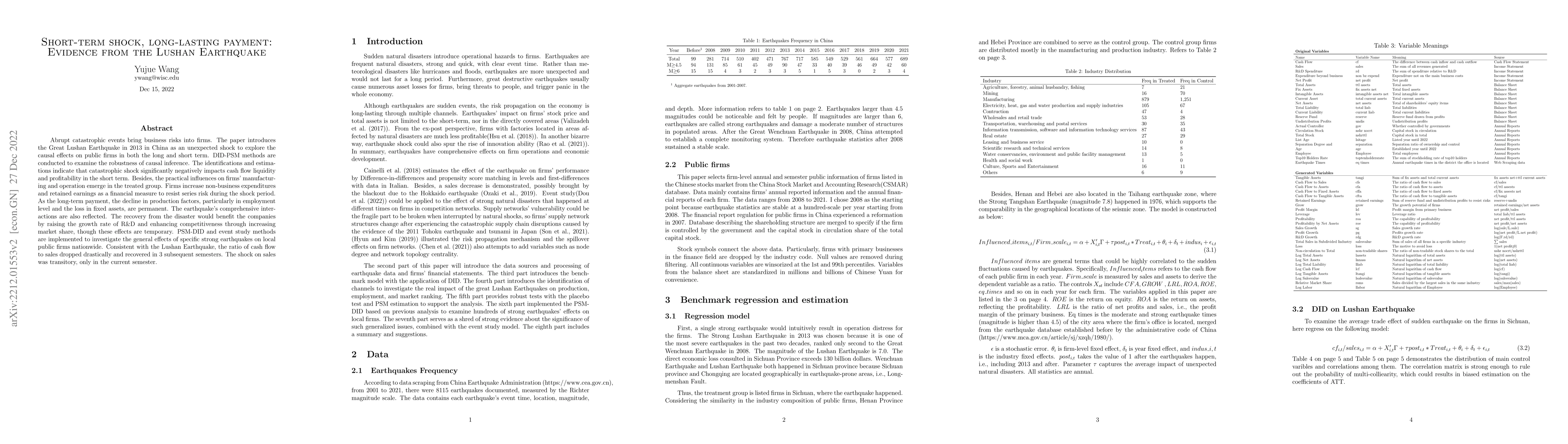

Abrupt catastrophic events bring business risks into firms. The paper introduces the Great Lushan Earthquake in 2013 in China as an unexpected shock to explore the causal effects on public firms in both the long and short term. DID-PSM methods are conducted to examine the robustness of causal inference. The identifications and estimations indicate that catastrophic shock significantly negatively impacts cash flow liquidity and profitability in the short term. Besides, the practical influences on firms' manufacturing and operation emerge in the treated group. Firms increase non-business expenditures and retained earnings as a financial measure to resist series risk during the shock period. As the long-term payment, the decline in production factors, particularly in employment level and the loss in fixed assets, are permanent. The earthquake's comprehensive interactions are also reflected. The recovery from the disaster would benefit the companies by raising the growth rate of R\&D and enhancing competitiveness through increasing market share, though these effects are temporary. PSM-DID and event study methods are implemented to investigate the general effects of specific strong earthquakes on local public firms nationwide. Consistent with the Lushan Earthquake, the ratio of cash flow to sales dropped drastically and recovered in 3 subsequent semesters. The shock on sales was transitory, only in the current semester.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)