Summary

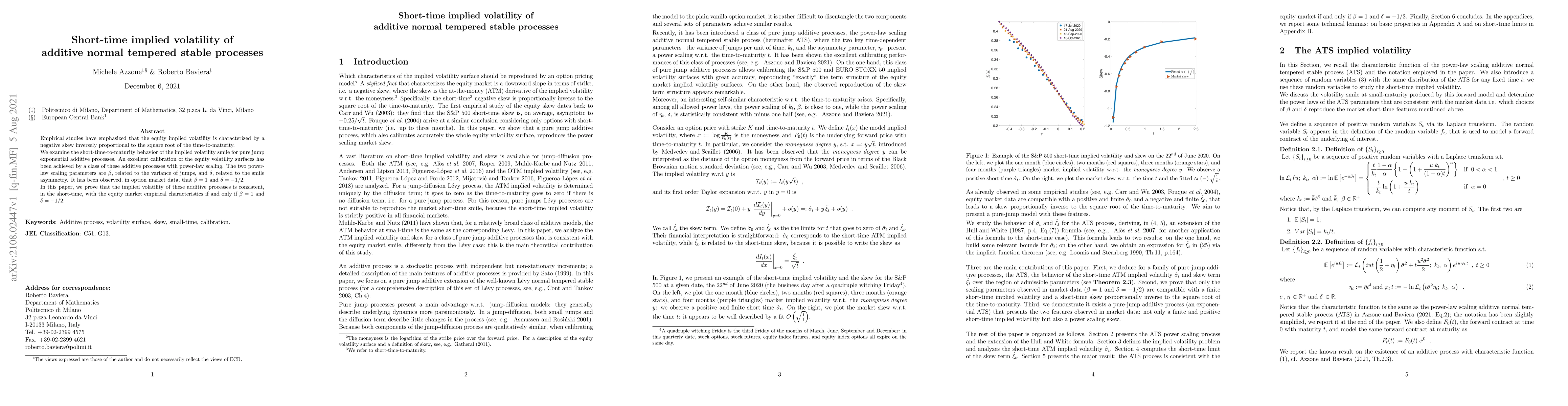

Empirical studies have emphasized that the equity implied volatility is characterized by a negative skew inversely proportional to the square root of the time-to-maturity. We examine the short-time-to-maturity behavior of the implied volatility smile for pure jump exponential additive processes. An excellent calibration of the equity volatility surfaces has been achieved by a class of these additive processes with power-law scaling. The two power-law scaling parameters are $\beta$, related to the variance of jumps, and $\delta$, related to the smile asymmetry. It has been observed, in option market data, that $\beta=1$ and $\delta=-1/2$. In this paper, we prove that the implied volatility of these additive processes is consistent, in the short-time, with the equity market empirical characteristics if and only if $\beta=1$ and $\delta=-1/2$.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAdditive normal tempered stable processes for equity derivatives and power law scaling

Michele Azzone, Roberto Baviera

Tempered Stable Processes with Time Varying Exponential Tails

Raphael Douady, Young Shin Kim, Kum-Hwan Roh

| Title | Authors | Year | Actions |

|---|

Comments (0)