Summary

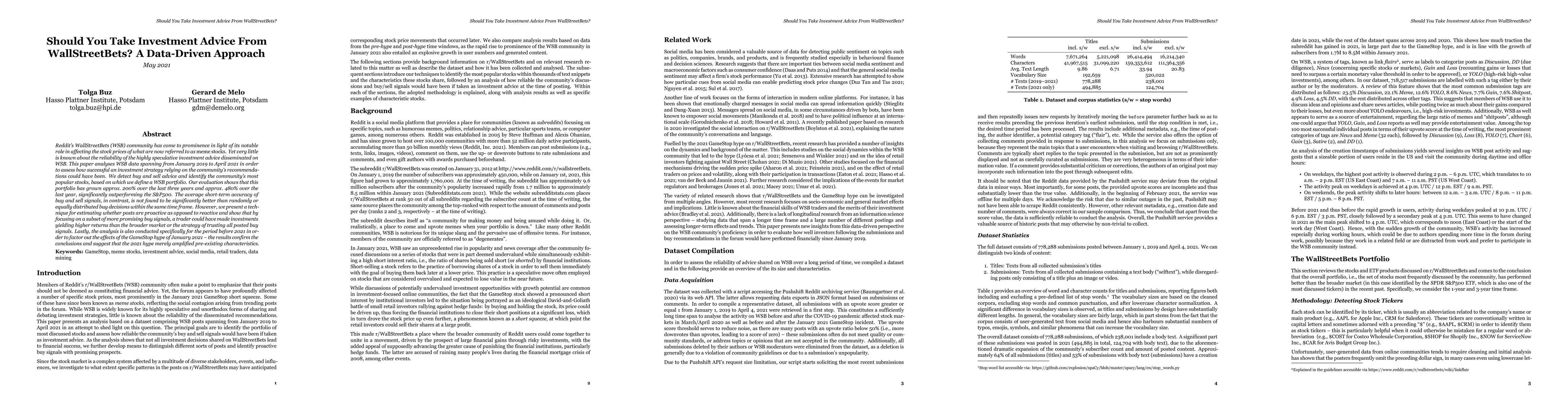

Reddit's WallStreetBets (WSB) community has come to prominence in light of its notable role in affecting the stock prices of what are now referred to as meme stocks. Yet very little is known about the reliability of the highly speculative investment advice disseminated on WSB. This paper analyses WSB data spanning from January 2019 to April 2021 in order to assess how successful an investment strategy relying on the community's recommendations could have been. We detect buy and sell advice and identify the community's most popular stocks, based on which we define a WSB portfolio. Our evaluation shows that this portfolio has grown approx. 200% over the last three years and approx. 480% over the last year, significantly outperforming the S&P500. The average short-term accuracy of buy and sell signals, in contrast, is not found to be significantly better than randomly or equally distributed buy decisions within the same time frame. However, we present a technique for estimating whether posts are proactive as opposed to reactive and show that by focusing on a subset of more promising buy signals, a trader could have made investments yielding higher returns than the broader market or the strategy of trusting all posted buy signals. Lastly, the analysis is also conducted specifically for the period before 2021 in order to factor out the effects of the GameStop hype of January 2021 - the results confirm the conclusions and suggest that the 2021 hype merely amplified pre-existing characteristics.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)