Summary

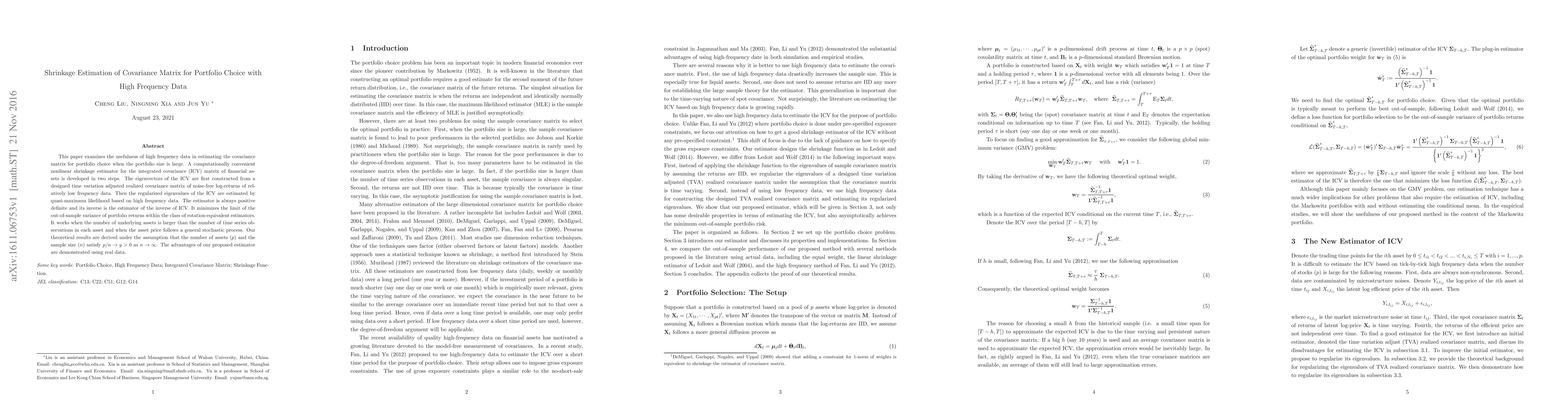

This paper examines the usefulness of high frequency data in estimating the covariance matrix for portfolio choice when the portfolio size is large. A computationally convenient nonlinear shrinkage estimator for the integrated covariance (ICV) matrix of financial assets is developed in two steps. The eigenvectors of the ICV are first constructed from a designed time variation adjusted realized covariance matrix of noise-free log-returns of relatively low frequency data. Then the regularized eigenvalues of the ICV are estimated by quasi-maximum likelihood based on high frequency data. The estimator is always positive definite and its inverse is the estimator of the inverse of ICV. It minimizes the limit of the out-of-sample variance of portfolio returns within the class of rotation-equivalent estimators. It works when the number of underlying assets is larger than the number of time series observations in each asset and when the asset price follows a general stochastic process. Our theoretical results are derived under the assumption that the number of assets (p) and the sample size (n) satisfy p/n \to y >0 as n goes to infty . The advantages of our proposed estimator are demonstrated using real data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPrecision versus Shrinkage: A Comparative Analysis of Covariance Estimation Methods for Portfolio Allocation

Shashi Jain, Sumanjay Dutta

Core Shrinkage Covariance Estimation for Matrix-variate Data

Andrew McCormack, Anru R. Zhang, Peter Hoff

| Title | Authors | Year | Actions |

|---|

Comments (0)