Summary

Existing deep learning methods for solving mean-field games (MFGs) with common noise fix the sampling common noise paths and then solve the corresponding MFGs. This leads to a nested-loop structure with millions of simulations of common noise paths in order to produce accurate solutions, which results in prohibitive computational cost and limits the applications to a large extent. In this paper, based on the rough path theory, we propose a novel single-loop algorithm, named signatured deep fictitious play, by which we can work with the unfixed common noise setup to avoid the nested-loop structure and reduce the computational complexity significantly. The proposed algorithm can accurately capture the effect of common uncertainty changes on mean-field equilibria without further training of neural networks, as previously needed in the existing machine learning algorithms. The efficiency is supported by three applications, including linear-quadratic MFGs, mean-field portfolio game, and mean-field game of optimal consumption and investment. Overall, we provide a new point of view from the rough path theory to solve MFGs with common noise with significantly improved efficiency and an extensive range of applications. In addition, we report the first deep learning work to deal with extended MFGs (a mean-field interaction via both the states and controls) with common noise.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

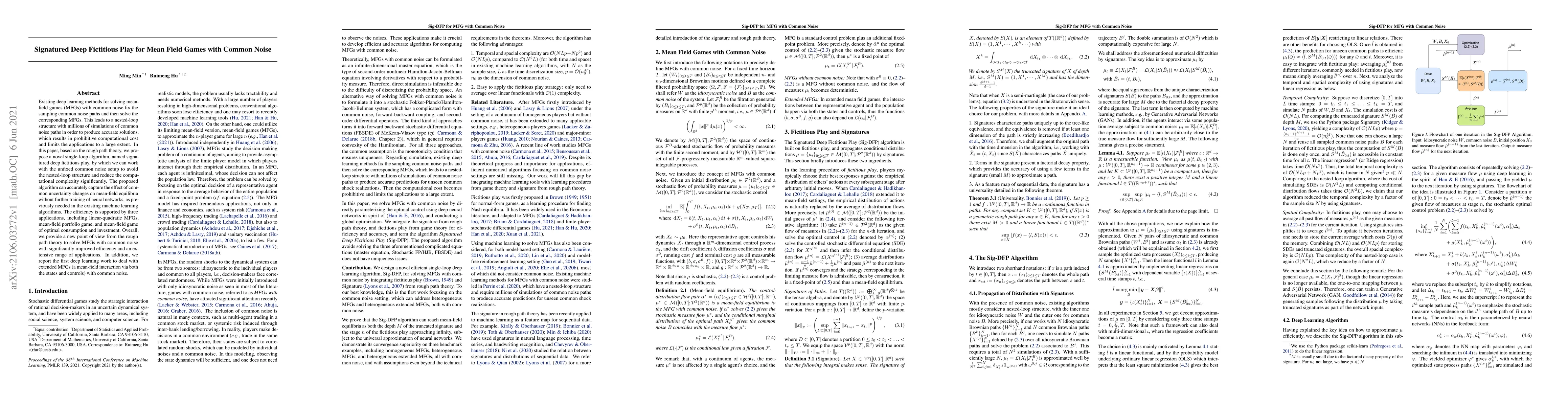

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFictitious Play via Finite Differences for Mean Field Games with Optimal Stopping

Yifan Luo, Zhennan Zhou, Chengfeng Shen

| Title | Authors | Year | Actions |

|---|

Comments (0)