Summary

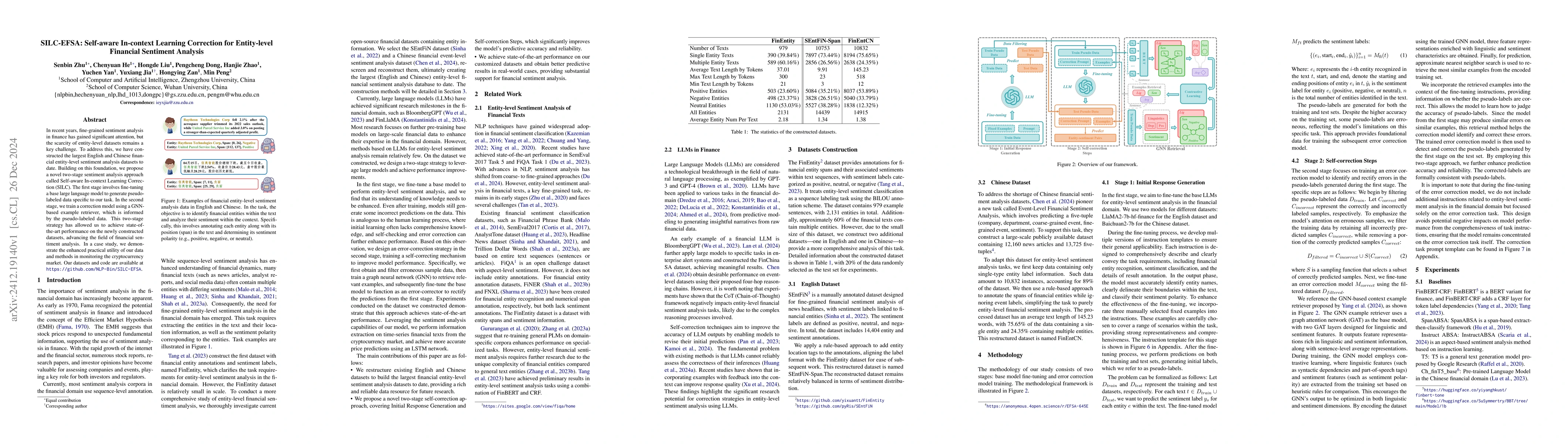

In recent years, fine-grained sentiment analysis in finance has gained significant attention, but the scarcity of entity-level datasets remains a key challenge. To address this, we have constructed the largest English and Chinese financial entity-level sentiment analysis datasets to date. Building on this foundation, we propose a novel two-stage sentiment analysis approach called Self-aware In-context Learning Correction (SILC). The first stage involves fine-tuning a base large language model to generate pseudo-labeled data specific to our task. In the second stage, we train a correction model using a GNN-based example retriever, which is informed by the pseudo-labeled data. This two-stage strategy has allowed us to achieve state-of-the-art performance on the newly constructed datasets, advancing the field of financial sentiment analysis. In a case study, we demonstrate the enhanced practical utility of our data and methods in monitoring the cryptocurrency market. Our datasets and code are available at https://github.com/NLP-Bin/SILC-EFSA.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersEFSA: Towards Event-Level Financial Sentiment Analysis

Qing He, Tianyu Chen, Yiming Zhang et al.

FinEntity: Entity-level Sentiment Classification for Financial Texts

Yi Yang, Yixuan Tang, Allen H Huang et al.

SEntFiN 1.0: Entity-Aware Sentiment Analysis for Financial News

Ankur Sinha, Rishu Kumar, Pekka Malo et al.

Dynamic Span Interaction and Graph-Aware Memory for Entity-Level Sentiment Classification

Md. Mithun Hossain, Md. Shakil Hossain, Sudipto Chaki et al.

No citations found for this paper.

Comments (0)