Summary

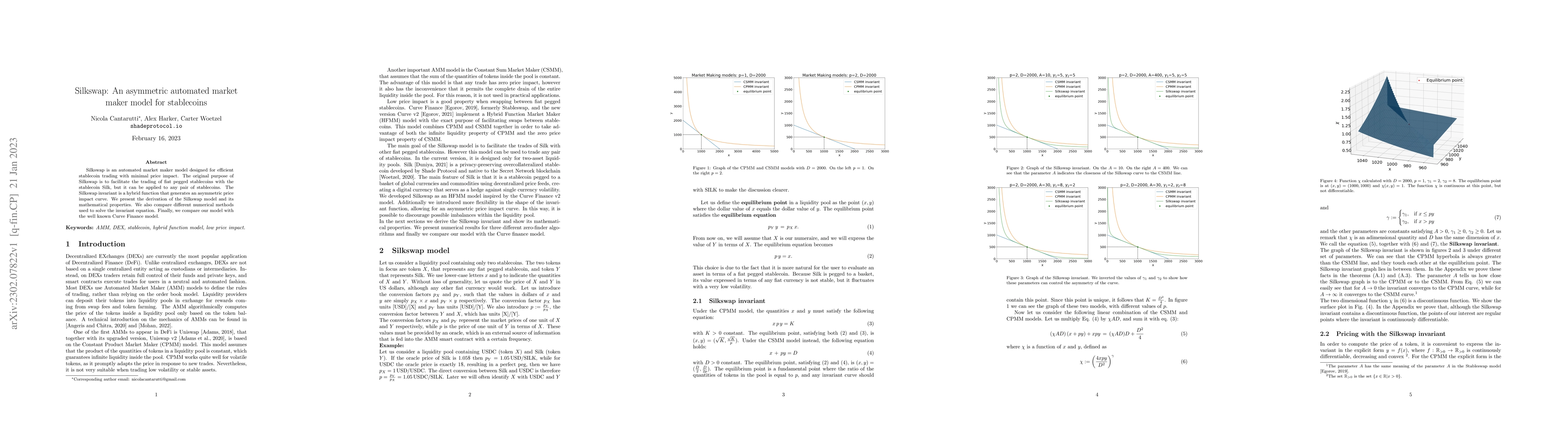

Silkswap is an automated market maker model designed for efficient stablecoin trading with minimal price impact. The original purpose of Silkswap is to facilitate the trading of fiat-pegged stablecoins with the stablecoin Silk, but it can be applied to any pair of stablecoins. The Silkswap invariant is a hybrid function that generates an asymmetric price impact curve. We present the derivation of the Silkswap model and its mathematical properties. We also compare different numerical methods used to solve the invariant equation. Finally, we compare our model with the well-known Curve Finance model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSoK: Decentralized Exchanges (DEX) with Automated Market Maker (AMM) Protocols

Jiahua Xu, Yebo Feng, Krzysztof Paruch et al.

Automated Market Maker on the XRP Ledger

Walter Hernandez Cruz, Jiahua Xu, Paolo Tasca et al.

An Automated Market Maker Minimizing Loss-Versus-Rebalancing

Bruno Mazorra, Conor McMenamin, Vanesa Daza

No citations found for this paper.

Comments (0)