Summary

The model is aimed to discriminate the 'good' and the 'bad' companies in Russian corporate sector based on their financial statements data based on Russian Accounting Standards. The data sample consists of 126 Russian public companies- issuers of Ruble bonds which represent about 36% of total number of corporate bonds issuers. 25 companies have defaulted on their debt in 2008-2009 which represent around 30% of default cases. No SPV companies were included in the sample. The model shows in-sample Gini AR about 73% and gives a reasonable and simple rule of mapping to external ratings. The model can be used to calculate implied credit rating for Russian companies which many of them don't have.

AI Key Findings

Generated Sep 03, 2025

Methodology

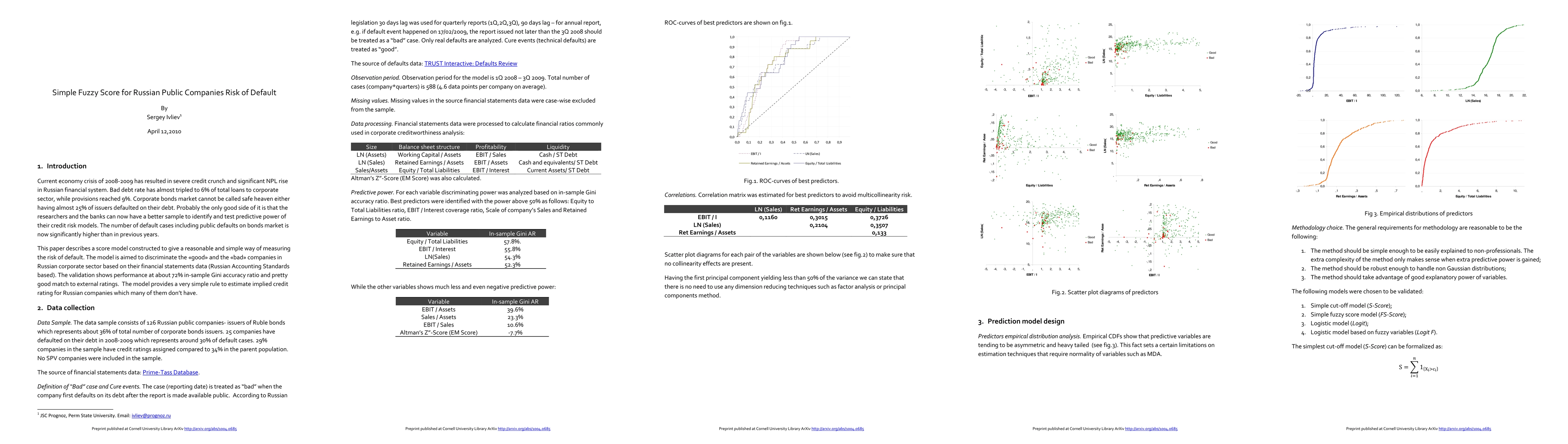

The FS-Score model is constructed based on a combination of financial statement analysis and external ratings calibration.

Key Results

- The FS-Score model provides a good explanation of the defaults of Russian public companies in 2008-2009.

- The model is simple to be used in wide risk-management practice as a fast risk measure.

- The FS-Score model is benchmarked to external ratings scale, allowing for the use of external Probabilities of Default (PD) from agencies.

Significance

This research is important because it provides a new and simple approach to credit risk assessment for Russian public companies.

Technical Contribution

The FS-Score model provides a new approach to credit risk assessment using external ratings calibration.

Novelty

This work is novel because it combines financial statement analysis with external ratings calibration for credit risk assessment.

Limitations

- The sample size is limited to 2008-2009 defaults.

- The model may not be robust in the presence of economic sector-specific factors.

Future Work

- Out-of-sample validation based on most recent defaults in Q4 2009 and Q1 2010.

- Extending the set of predictors based on financial statements and other sources.

- Analyzing stability of model across economy sectors and in time.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)