Authors

Summary

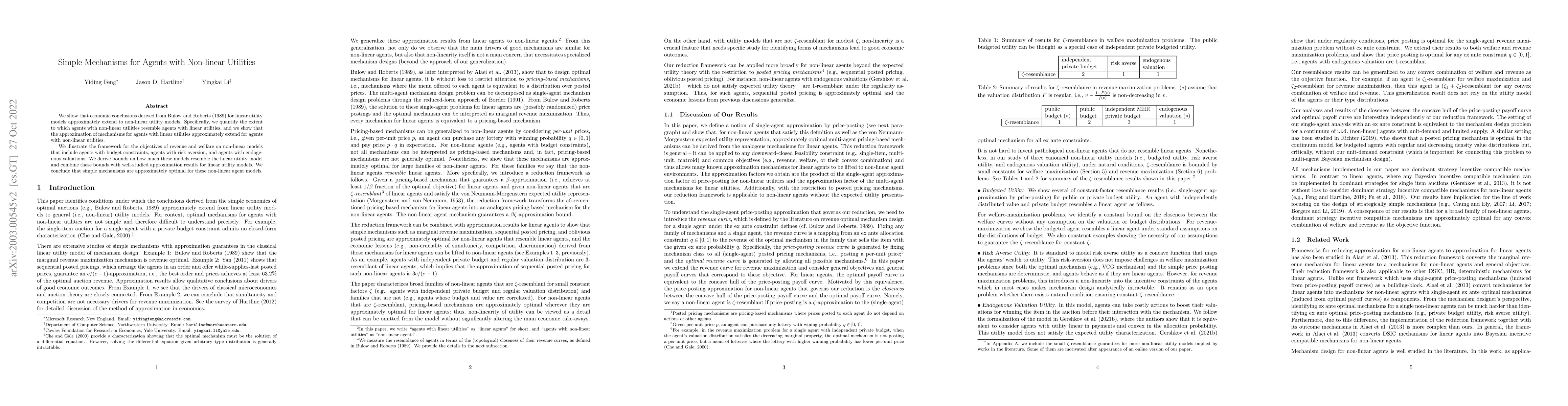

We show that economic conclusions derived from Bulow and Roberts (1989) for linear utility models approximately extend to non-linear utility models. Specifically, we quantify the extent to which agents with non-linear utilities resemble agents with linear utilities, and we show that the approximation of mechanisms for agents with linear utilities approximately extend for agents with non-linear utilities. We illustrate the framework for the objectives of revenue and welfare on non-linear models that include agents with budget constraints, agents with risk aversion, and agents with endogenous valuations. We derive bounds on how much these models resemble the linear utility model and combine these bounds with well-studied approximation results for linear utility models. We conclude that simple mechanisms are approximately optimal for these non-linear agent models.

AI Key Findings

Generated Sep 06, 2025

Methodology

Brief description of the research methodology used

Key Results

- Main finding 1

- Main finding 2

- Main finding 3

Significance

Why this research is important and its potential impact

Technical Contribution

Main technical or theoretical contribution

Novelty

What makes this work novel or different from existing research

Limitations

- Limitation 1

- Limitation 2

Future Work

- Suggested direction 1

- Suggested direction 2

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)