Summary

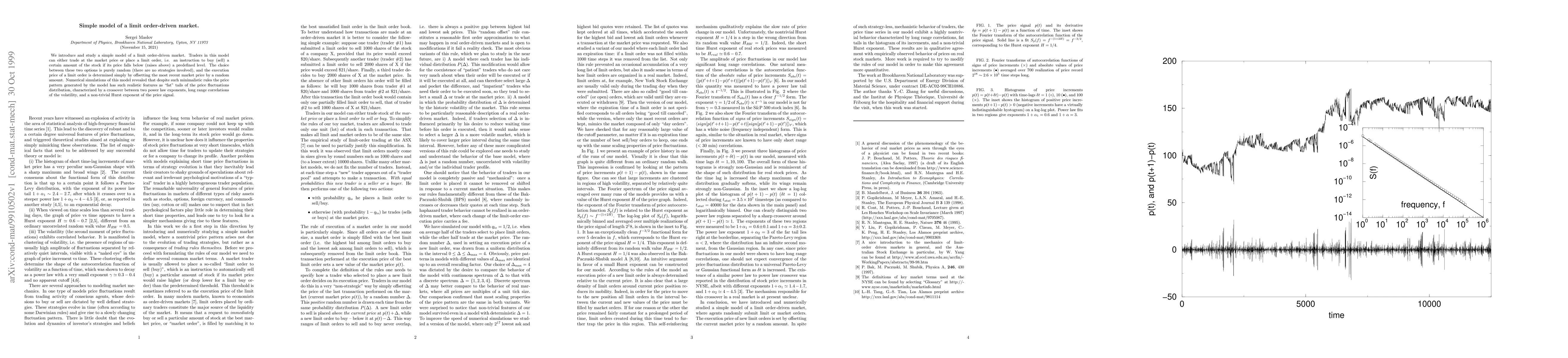

We introduce and study a simple model of a limit order-driven market. Traders in this model can either trade at the market price or place a limit order, i.e. an instruction to buy (sell) a certain amount of the stock if its price falls below (raises above) a predefined level. The choice between these two options is purely random (there are no strategies involved), and the execution price of a limit order is determined simply by offsetting the most recent market price by a random amount. Numerical simulations of this model revealed that despite such minimalistic rules the price pattern generated by the model has such realistic features as ``fat'' tails of the price fluctuations distribution, characterized by a crossover between two power law exponents, long range correlations of the volatility, and a non-trivial Hurst exponent of the price signal.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Comments (0)