Summary

We study the problem of selling a divisible item to agents who have concave valuation functions for fractions of the item. This is a fundamental problem with apparent applications to pricing communication bandwidth or cloud computing services. We focus on simple sequential posted pricing mechanisms that use linear pricing, i.e., a fixed price for the whole item and proportional prices for fractions of it. We present results of the following form that can be thought of as analogs of the well-known prophet inequality of Samuel-Cahn (1984). For $\rho\approx 32\%$, if there is a linear pricing so that sequential posted pricing sells a $\rho$-fraction of the item, this results in a $\rho$-approximation of the optimal social welfare. The value of $\rho$ can be improved to approximately $42\%$ if sequential posted pricing considers the agents in random order. We also show that the best linear pricing yields an expected revenue that is at most $O(\kappa^2)$ times smaller than the optimal one, where $\kappa$ is a bound on the curvature of the valuation functions. The proof extends and exploits the approach of Alaei et al. (2019) and bounds the revenue gap by the objective value of a mathematical program. The dependence of the revenue gap on $\kappa$ is unavoidable as a lower bound of $\Omega(\ln{\kappa})$ indicates.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

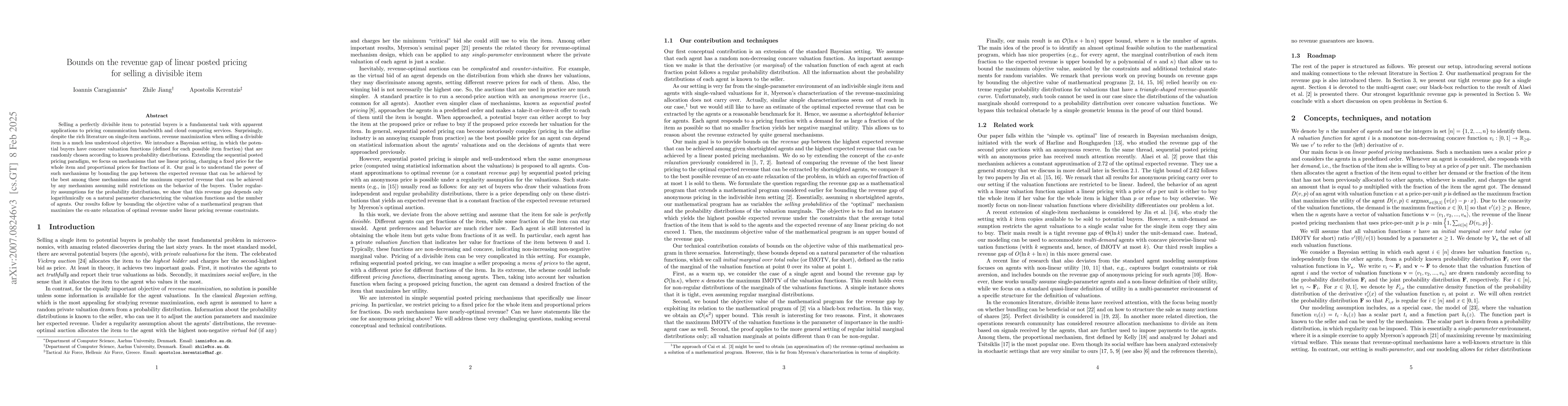

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSample Complexity of Posted Pricing for a Single Item

Will Ma, Thomas Kesselheim, Sahil Singla et al.

No citations found for this paper.

Comments (0)