Summary

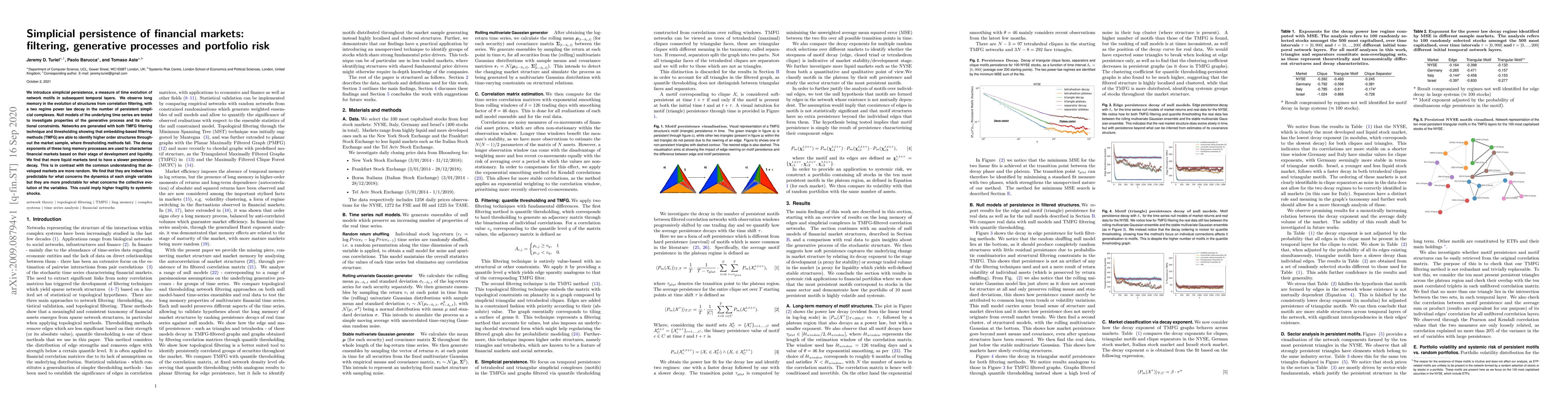

We introduce simplicial persistence, a measure of time evolution of network motifs in subsequent temporal layers. We observe long memory in the evolution of structures from correlation filtering, with a two regime power law decay in the number of persistent simplicial complexes. Null models of the underlying time series are tested to investigate properties of the generative process and its evolutional constraints. Networks are generated with both TMFG filtering technique and thresholding showing that embedding-based filtering methods (TMFG) are able to identify higher order structures throughout the market sample, where thresholding methods fail. The decay exponents of these long memory processes are used to characterise financial markets based on their stage of development and liquidity. We find that more liquid markets tend to have a slower persistence decay. This is in contrast with the common understanding that developed markets are more random. We find that they are indeed less predictable for what concerns the dynamics of each single variable but they are more predictable for what concerns the collective evolution of the variables. This could imply higher fragility to systemic shocks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)