Authors

Summary

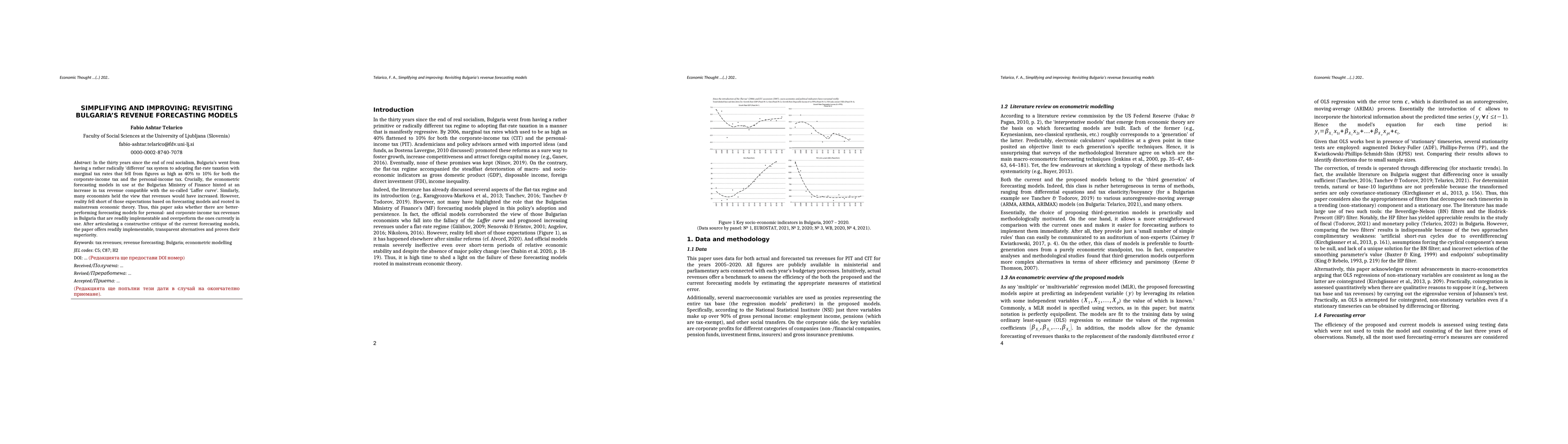

In the thirty years since the end of real socialism, Bulgaria's went from having a rather radically 'different' tax system to adopting flat-rate taxation with marginal tax rates that fell from figures as high as 40% to 10% for both the corporate-income tax and the personal-income tax. Crucially, the econometric forecasting models in use at the Bulgarian Ministry of Finance hinted at an increase in tax revenue compatible with the so-called 'Laffer curve'. Similarly, many economists held the view that revenues would have increased. However, reality fell short of those expectations based on forecasting models and rooted in mainstream economic theory. Thus, this paper asks whether there are betterperforming forecasting models for personal-and corporate-income tax-revenues in Bulgaria that are readily implementable and overperform the ones currently in use. After articulating a constructive critique of the current forecasting models, the paper offers readily implementable, transparent alternatives and proves their superiority.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMultivariate Dynamic Modeling for Bayesian Forecasting of Business Revenue

Graham Tierney, Christoph Hellmayr, Mike West et al.

Time-SSM: Simplifying and Unifying State Space Models for Time Series Forecasting

Qingsong Wen, Ziyu Zhou, Yuxuan Liang et al.

Optimizing Revenue Maximization and Demand Learning in Airline Revenue Management

Jean-Charles Regin, Giovanni Gatti Pinheiro, Michael Defoin-Platel

No citations found for this paper.

Comments (0)