Summary

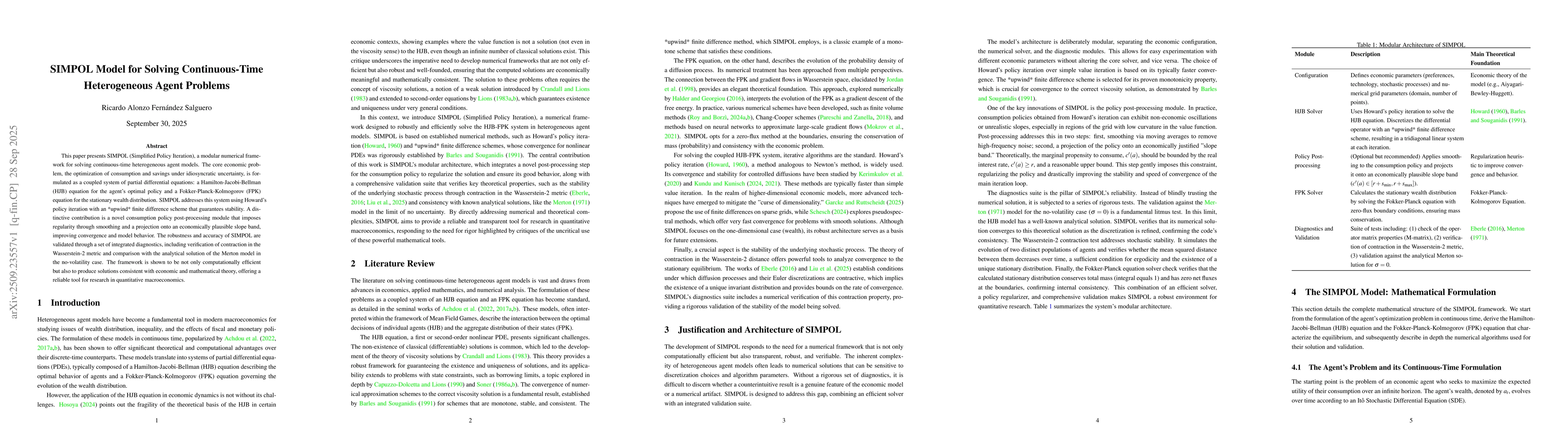

This paper presents SIMPOL (Simplified Policy Iteration), a modular numerical framework for solving continuous-time heterogeneous agent models. The core economic problem, the optimization of consumption and savings under idiosyncratic uncertainty, is formulated as a coupled system of partial differential equations: a Hamilton-Jacobi-Bellman (HJB) equation for the agent's optimal policy and a Fokker-Planck-Kolmogorov (FPK) equation for the stationary wealth distribution. SIMPOL addresses this system using Howard's policy iteration with an *upwind* finite difference scheme that guarantees stability. A distinctive contribution is a novel consumption policy post-processing module that imposes regularity through smoothing and a projection onto an economically plausible slope band, improving convergence and model behavior. The robustness and accuracy of SIMPOL are validated through a set of integrated diagnostics, including verification of contraction in the Wasserstein-2 metric and comparison with the analytical solution of the Merton model in the no-volatility case. The framework is shown to be not only computationally efficient but also to produce solutions consistent with economic and mathematical theory, offering a reliable tool for research in quantitative macroeconomics.

AI Key Findings

Generated Oct 01, 2025

Methodology

The paper introduces SIMPOL, a modular numerical framework combining Howard's policy iteration with an upwind finite difference scheme to solve continuous-time heterogeneous agent models. It integrates a policy post-processing module for smoothing and slope constraints, along with diagnostics for stability and accuracy.

Key Results

- SIMPOL produces solutions consistent with economic and mathematical theory, validated against the Merton model and Wasserstein-2 contraction metrics.

- The framework demonstrates robust convergence and computational efficiency, even with complex dynamics and uncertainty.

- The stationary wealth distribution calculated via the Fokker-Planck equation shows mass conservation and aligns with Monte Carlo simulations.

Significance

This research provides a reliable computational tool for quantitative macroeconomics, enabling accurate analysis of heterogeneous agent models with continuous-time dynamics and uncertainty. It bridges gaps between economic theory and numerical implementation.

Technical Contribution

SIMPOL introduces a novel policy post-processing module with smoothing and slope constraints, along with a robust upwind scheme for solving the HJB equation, ensuring numerical stability and economic realism.

Novelty

The combination of Howard's policy iteration with an upwind finite difference scheme, along with the policy post-processing module, represents a novel approach to solving heterogeneous agent models with improved convergence and economic consistency.

Limitations

- The framework assumes constant volatility and may require adaptation for more complex stochastic environments.

- The post-processing module's effectiveness depends on parameter choices for slope constraints.

Future Work

- Extending the framework to incorporate multiple assets and more complex income processes.

- Investigating the application of SIMPOL to models with aggregate shocks or heterogeneous preferences.

- Exploring the use of adaptive grid techniques for improved computational efficiency.

Paper Details

PDF Preview

Similar Papers

Found 4 papersGlobal Solutions to Master Equations for Continuous Time Heterogeneous Agent Macroeconomic Models

Mathieu Laurière, Zhouzhou Gu, Sebastian Merkel et al.

A Model for Multi-Agent Heterogeneous Interaction Problems

Pratik Chaudhari, Christopher D. Hsu, Mulugeta A. Haile

Comments (0)