Summary

There is currently an increasing interest in large vector autoregressive (VAR) models. VARs are popular tools for macroeconomic forecasting and use of larger models has been demonstrated to often improve the forecasting ability compared to more traditional small-scale models. Mixed-frequency VARs deal with data sampled at different frequencies while remaining within the realms of VARs. Estimation of mixed-frequency VARs makes use of simulation smoothing, but using the standard procedure these models quickly become prohibitive in nowcasting situations as the size of the model grows. We propose two algorithms that alleviate the computational efficiency of the simulation smoothing algorithm. Our preferred choice is an adaptive algorithm, which augments the state vector as necessary to sample also monthly variables that are missing at the end of the sample. For large VARs, we find considerable improvements in speed using our adaptive algorithm. The algorithm therefore provides a crucial building block for bringing the mixed-frequency VARs to the high-dimensional regime.

AI Key Findings - Processing

Key findings are being generated. Please check back in a few minutes.

Paper Details

PDF Preview

Key Terms

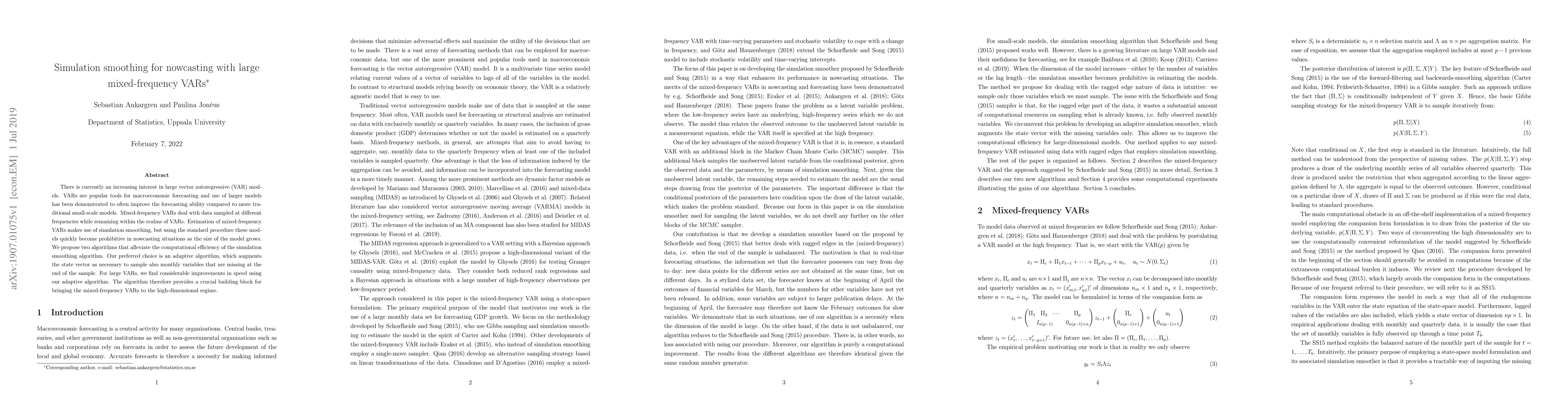

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNowcasting with mixed frequency data using Gaussian processes

Niko Hauzenberger, Massimiliano Marcellino, Michael Pfarrhofer et al.

Efficient Estimation of State-Space Mixed-Frequency VARs: A Precision-Based Approach

Joshua C. C. Chan, Aubrey Poon, Dan Zhu

| Title | Authors | Year | Actions |

|---|

Comments (0)