Authors

Summary

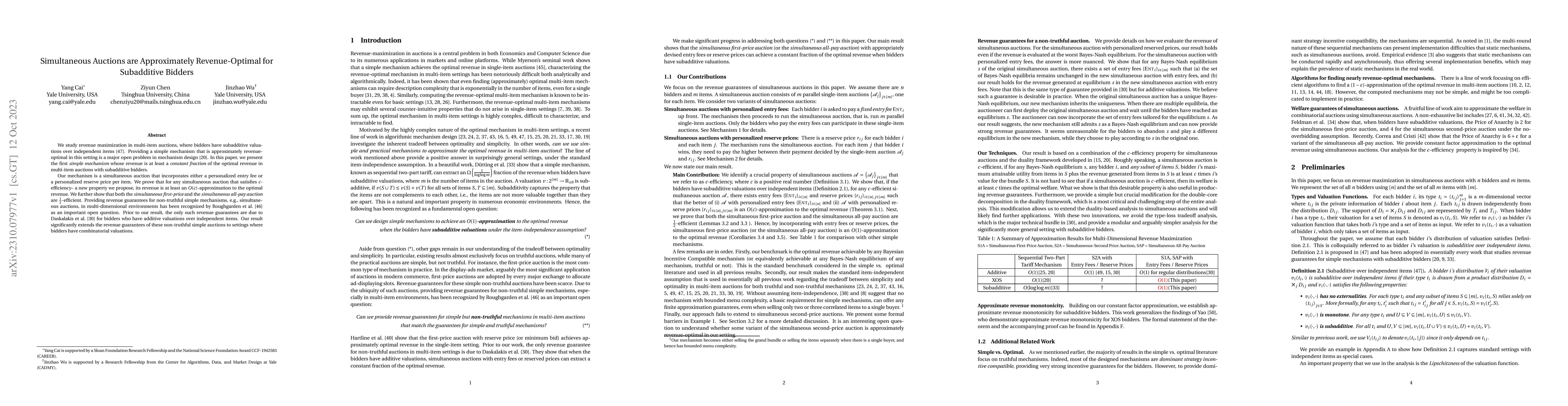

We study revenue maximization in multi-item auctions, where bidders have subadditive valuations over independent items. Providing a simple mechanism that is approximately revenue-optimal in this setting is a major open problem in mechanism design. In this paper, we present the first \emph{simple mechanism} whose revenue is at least a \emph{constant fraction} of the optimal revenue in multi-item auctions with subadditive bidders. Our mechanism is a simultaneous auction that incorporates either a personalized entry fee or a personalized reserve price per item. We prove that for any simultaneous auction that satisfies c-efficiency -- a new property we propose, its revenue is at least an $O(c)$-approximation to the optimal revenue. We further show that both the \emph{simultaneous first-price} and the \emph{simultaneous all-pay auction} are $1\over 2$-efficient. Providing revenue guarantees for non-truthful simple mechanisms, e.g., simultaneous auctions, in multi-dimensional environments has been recognized by Roughgarden et al. as an important open question. Prior to our result, the only such revenue guarantees are due to Daskalakis et al. for bidders who have additive valuations over independent items. Our result significantly extends the revenue guarantees of these non-truthful simple auctions to settings where bidders have combinatorial valuations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)