Authors

Summary

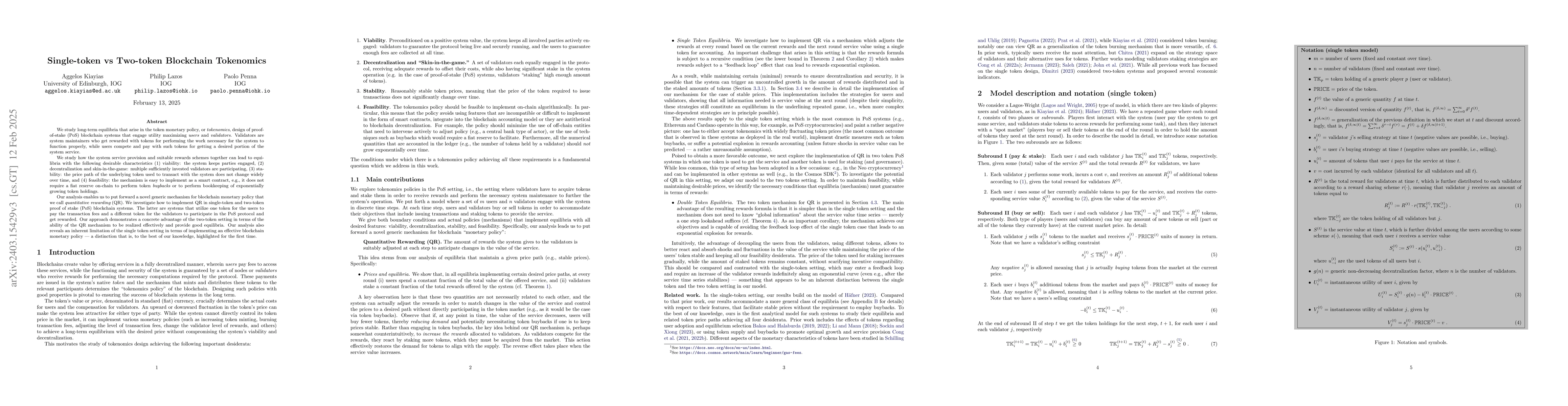

We consider long-term equilibria that arise in the tokenomics design of proof-of-stake (PoS) blockchain systems that comprise of users and validators, both striving to maximize their own utilities. Validators are system maintainers who get rewarded with tokens for performing the work necessary for the system to function properly, while users compete and pay with such tokens for getting a desired portion of the system service. We study how the system service provision and suitable rewards schemes together can lead to equilibria with desirable characteristics (1) viability: the system keeps parties engaged, (2) decentralization: multiple validators are participating, (3) stability: the price path of the underlying token used to transact with the system does not change widely over time, and (4) feasibility: the mechanism is easy to implement as a smart contract, i.e., it does not require fiat reserves on-chain for buy back of tokens or to perform bookkeeping of exponentially growing token holdings. Our analysis enables to put forward a novel generic mechanism for blockchain ``monetary policy'' that we call {\em quantitative rewarding} (QR). We investigate how to implement QR in single-token and two-token proof of stake (PoS) blockchain systems. The latter are systems that utilize one token for the users to pay the transaction fees and a different token for the validators to participate in the PoS protocol and get rewarded. Our approach demonstrates a concrete advantage of the two-token setting in terms of the ability of the QR mechanism to be realized effectively and provide good equilibria. Our analysis also reveals an inherent limitation of the single token setting in terms of implementing an effective blockchain monetary policy - a distinction that is, to the best of our knowledge, highlighted for the first time.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersToken-based Insurance Solutions on Blockchain

Jiahua Xu, Nikhil Vadgama, Simon Cousaert

Unravelling Token Ecosystem of EOSIO Blockchain

Bo Liu, Zibin Zheng, Muhammad Imran et al.

No citations found for this paper.

Comments (0)