Authors

Summary

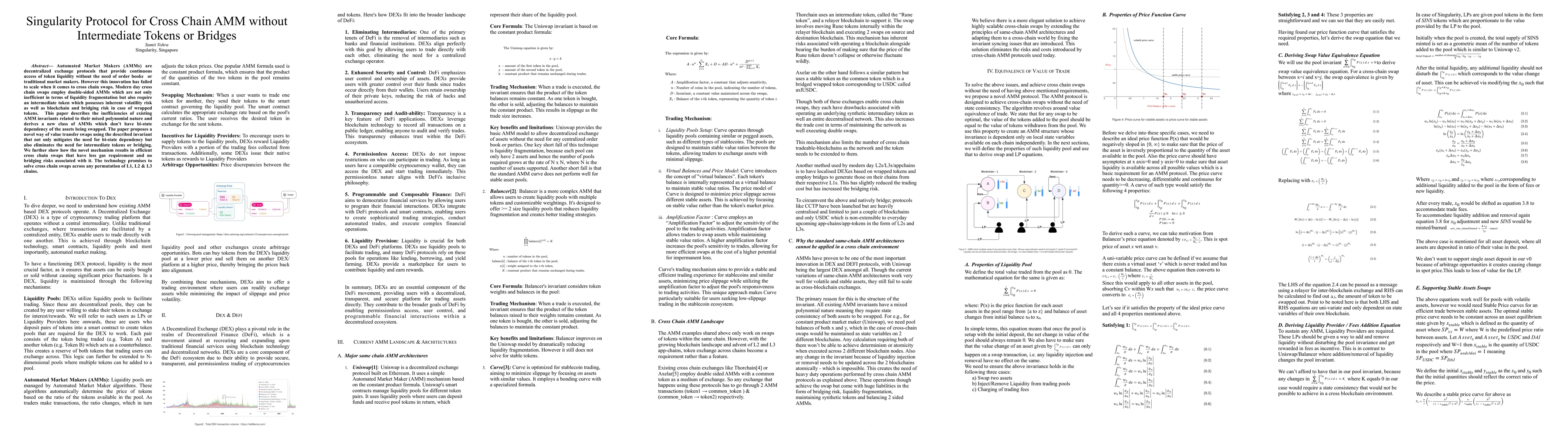

Automated Market Makers (AMMs) are decentralized exchange protocols that provide continuous access to token liquidity without the need for order books or traditional market makers. However, this innovation has failed to scale when it comes to cross-chain swaps. Modern cross-chain swaps employ double-sided AMMs, which are not only inefficient due to liquidity fragmentation but also require an intermediate token. This introduces inherent volatility risk as well as blockchain and bridging risk, especially in the case of wrapped tokens. This paper describes the inefficiencies of existing AMM invariants, particularly their mixed polynomial nature, and derives a new class of AMMs that do not have bi-state dependency between the assets being swapped. We propose a novel method of value transfer swaps using the described invariant that mitigates the need for bi-state dependency and eliminates the need for intermediate tokens or bridging. Furthermore, we show how this mechanism enables efficient cross-chain swaps with lower gas requirements and no bridging risks. The proposed technology is designed to support cross-chain swaps across any permutation of L1, L2, and L3 blockchains.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersXChainWatcher: Monitoring and Identifying Attacks in Cross-Chain Bridges

Miguel Correia, André Augusto, Rafael Belchior et al.

zkBridge: Trustless Cross-chain Bridges Made Practical

Dawn Song, Fan Zhang, Jiaheng Zhang et al.

SoK: Security of Cross-chain Bridges: Attack Surfaces, Defenses, and Open Problems

Mengya Zhang, Xiaokuan Zhang, Zhiqiang Lin et al.

Count of Monte Crypto: Accounting-based Defenses for Cross-Chain Bridges

Enze Liu, Stefan Savage, Katherine Izhikevich et al.

No citations found for this paper.

Comments (0)