Summary

We compute a sharp small-time estimate for implied volatility under a general uncorrelated local-stochastic volatility model. For this we use the Bellaiche \cite{Bel81} heat kernel expansion combined with Laplace's method to integrate over the volatility variable on a compact set, and (after a gauge transformation) we use the Davies \cite{Dav88} upper bound for the heat kernel on a manifold with bounded Ricci curvature to deal with the tail integrals. If the correlation $\rho < 0$, our approach still works if the drift of the volatility takes a specific functional form and there is no local volatility component, and our results include the SABR model for $\beta=1, \rho \le 0$. \bl{For uncorrelated stochastic volatility models, our results also include a SABR-type model with $\beta=1$ and an affine mean-reverting drift, and the exponential Ornstein-Uhlenbeck model.} We later augment the model with a single jump-to-default with intensity $\lm$, which produces qualitatively different behaviour for the short-maturity smile; in particular, for $\rho=0$, log-moneyness $x > 0$, the implied volatility increases by $\lm f(x) t +o(t) $ for some function $f(x)$ which blows up as $x \searrow 0$. Finally, we compare our result with the general asymptotic expansion in Lorig, Pagliarani \& Pascucci \cite{LPP15}, and we verify our results numerically for the SABR model using Monte Carlo simulation and the exact closed-form solution given in Antonov \& Spector \cite{AS12} for the case $\rho=0$.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

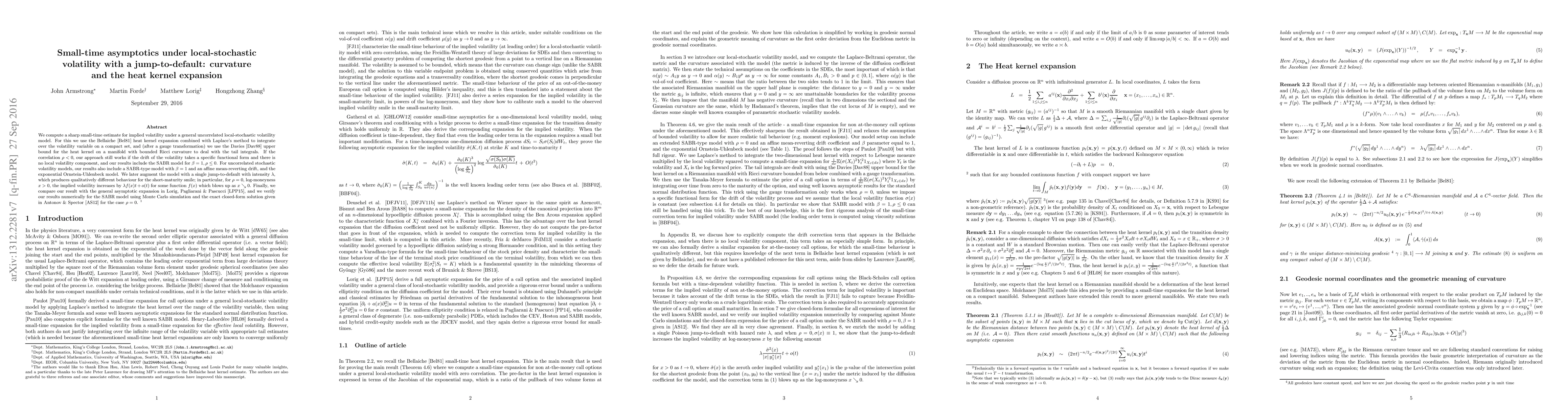

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)