Summary

We study small-time central limit theorems for stochastic Volterra integral equations with H\"older continuous coefficients and general locally square integrable Volterra kernels. We prove the convergence of the finite-dimensional distributions, a functional CLT, and limit theorems for smooth transformations of the process, which covers a large class of Volterra kernels that includes rough models based on Riemann-Liouville kernels with short- and long-range dependencies. To illustrate our results, we derive asymptotic pricing formulae for digital calls on the realized variance in three different regimes. The latter provides a robust and model-independent pricing method for small maturities in rough volatility models. Finally, for the case of completely monotone kernels, we introduce a flexible framework of Hilbert space-valued Markovian lifts and derive analogous limit theorems for such lifts.

AI Key Findings - Failed

Key findings generation failed. Failed to start generation process

Paper Details

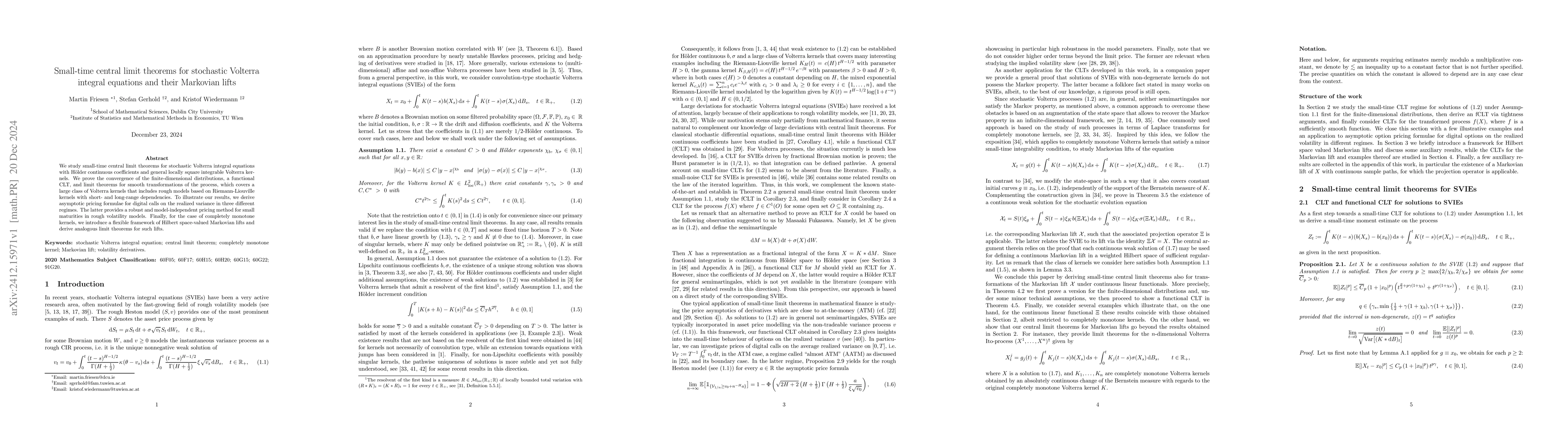

PDF Preview

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)